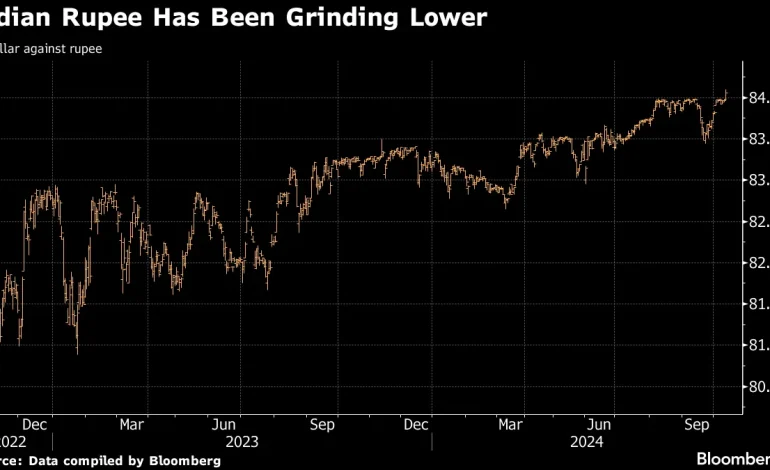

The Indian rupee fell past the 84 mark to the US dollar for the first time ever on Friday, reaching a new record low of 84.0975, Bloomberg reports.

The decline is attributed to a confluence of factors, including heavy foreign outflows from stocks and bonds, and a shift in the Reserve Bank of India’s (RBI) monetary policy stance.

Offshore investors have pulled out a $5.7 billion from Indian stocks this month, while bond outflows have reached $125 million, according to Bloomberg data. This outflow of foreign capital has put immense pressure on the rupee, pushing it to new lows.

The rupee has been steadily weakening throughout the year, setting new record lows. However, the central bank’s focus on currency stability kept the currency within a narrow range. But the RBI’s move on Wednesday to shift its stance from hawkish to “neutral” has further fuelled downward pressure on the rupee.

The change in stance, signaling a potential path towards interest rate cuts, has spurred bets that the RBI will loosen monetary policy. This, in turn, has made the rupee less attractive for foreign investors.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned