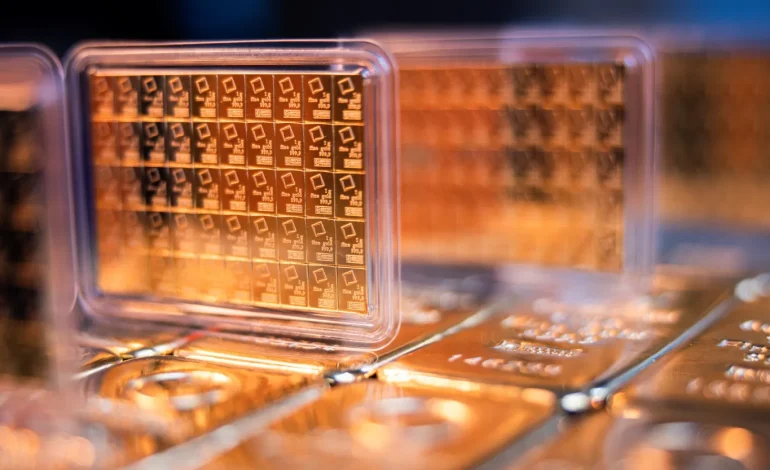

Gold Inches Higher Amid Weaker Dollar and Political Uncertainty

Gold prices saw modest gains on Wednesday, supported by a weaker US dollar and ongoing political uncertainty following the latest trade measures announced by President Trump.

As of 0955 GMT, spot gold edged up 0.1% to $2,918.83 per ounce, extending its nearly 1% rise from Tuesday. The precious metal reached a record high of $2,956.15 on February 24 and has gained 11% so far in 2024. Meanwhile, US gold futures rose 0.3% to $2,929.70.

Independent analyst Ross Norman noted that “uncertainty is food and water for gold, and hence the bias on prices is to the upside.” He added that while gold is consolidating its recent gains, the market remains focused on the key $3,000 level.

The US dollar index (.DXY) fell to a three-month low, making gold more attractive to investors holding other currencies. A weaker dollar often boosts demand for gold, as it becomes cheaper for buyers using foreign currencies.

Meanwhile, in a recent address to Congress, President Trump announced plans to implement additional tariffs on April 2, including “reciprocal tariffs” and other measures aimed at addressing trade imbalances. This follows the introduction of new 25% tariffs on Mexican and Canadian imports, along with a doubling of tariffs on Chinese goods to 20%.

China, the world’s largest consumer of gold, has responded by introducing additional fiscal stimulus measures to support domestic consumption and mitigate the effects of the escalating trade war.

Investors are also awaiting key US employment data, including the ADP employment report later on Wednesday and the US nonfarm payrolls report on Friday, which could influence expectations on future interest rate decisions.

“Geopolitical events and tariffs are currently overshadowing economic data,” said Zain Vawda, a market analyst at MarketPulse by OANDA.

He added that unless the employment reports significantly deviate from expectations, their impact on gold prices may be limited.

Spot silver advanced 1% to $32.32 per ounce, platinum gained 1% to $970.20, and palladium rose 1% to $951.50.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned