Elon Musk’s Starlink has taken a major step toward entering India’s vast internet market by securing partnerships with the country’s two largest telecom providers, Reliance Jio and Bharti Airtel.

These agreements, announced this week, mark a significant breakthrough for the satellite internet provider, which has been trying to establish a presence in India for years. However, Starlink’s entry still hinges on obtaining regulatory approval from the Indian government.

India’s internet and telecom industry is dominated by Reliance Jio and Bharti Airtel, owned by two of the country’s most influential business figures—Mukesh Ambani and Sunil Bharti Mittal. Initially, both companies had resisted Starlink’s entry, citing concerns over market competition and regulatory policies. However, in a surprising turn, each announced their respective agreements with Starlink within hours of each other.

Reliance Jio stated that the partnership aims to “deliver reliable broadband services across the country, including in the most remote and rural regions.” Bharti Airtel echoed similar sentiments, emphasizing the goal of expanding high-speed internet connectivity.

This support from major industry players strengthens Starlink’s position as it awaits approval from Indian regulators. SpaceX President Gwynne Shotwell expressed optimism, saying she looked forward to receiving the necessary authorization to expand Starlink’s services in India.

Despite the momentum from these partnerships, Starlink faces regulatory hurdles. The Indian government, known for its strict oversight of the telecom sector, has previously denied Starlink permission to operate. In 2021, India’s Ministry of Communications instructed Starlink to stop accepting preorders until it secured the required licenses.

Another key issue is the duration of Starlink’s operating license. The company has requested a 20-year spectrum allotment, while the Indian government and local telecom firms prefer a shorter, 3-5 year period. This approach would allow regulators to reassess pricing and market conditions before committing to long-term licenses. The Telecom Regulatory Authority of India (TRAI) is expected to finalize its recommendations on this matter soon.

Starlink’s technology, which relies on low-Earth orbit satellites, offers a promising solution for improving internet access in rural and remote areas of India. Ground-based networks often struggle to provide reliable coverage in such locations, making satellite-based services an attractive alternative.

However, questions remain about how Starlink will operate within the Indian market. Industry analysts suggest two possible scenarios:

- Starlink as a Direct Competitor – If Starlink offers its own internet services, it could disrupt the existing telecom market, which is currently dominated by Jio and Airtel. This would increase competition but could also lead to regulatory scrutiny.

- Starlink as a Service Provider – If Starlink supplies satellite connectivity exclusively through Jio and Airtel, it may reinforce the existing duopoly rather than introducing new competition.

Experts warn that while satellite-based broadband could improve connectivity, it may not significantly impact pricing. India already has some of the world’s lowest mobile data costs, with rates as low as $0.14 per gigabyte. If Starlink does not offer its services independently, consumers may not see major price benefits.

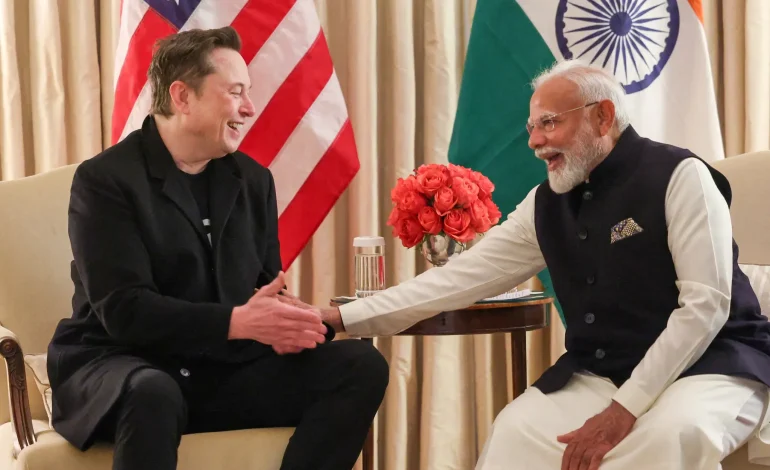

Starlink’s expansion into India also carries geopolitical implications. Musk’s growing influence in global business and politics has drawn attention, particularly as he maintains close ties with former US President Donald Trump. India’s government, led by Prime Minister Narendra Modi, has been strengthening its ties with both the US and major American business leaders. Modi’s recent meetings with Musk, as well as other high-profile engagements with US officials, suggest that business and political considerations may play a role in shaping Starlink’s future in India.

Moreover, concerns have been raised about Starlink’s ability to control internet access in times of geopolitical tension. The satellite provider has previously faced criticism for restricting services in conflict zones, raising questions about who will have control over connectivity in India—Starlink itself or its Indian partners.

The New York Times, Bloomberg, and Reuters contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned