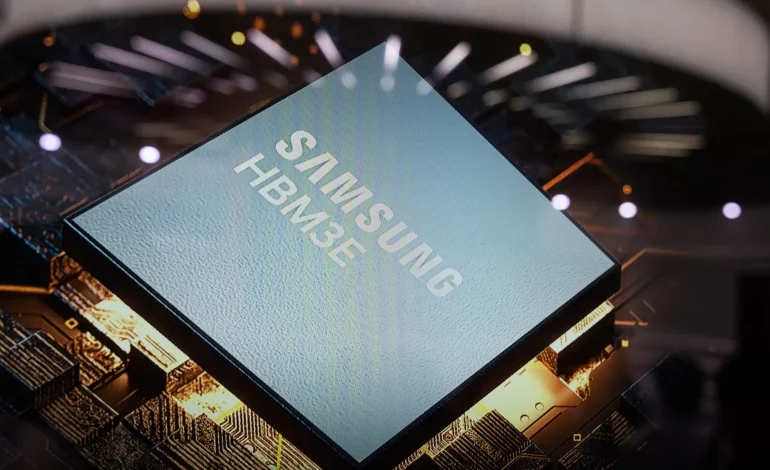

Samsung Electronics Co. is doubling down on its efforts to dominate the high-bandwidth memory (HBM) market after facing shareholder criticism for its slower-than-expected progress in the booming artificial intelligence sector, Bloomberg reports.

Newly appointed co-CEO Jun Young-hyun, head of the chip business, addressed concerns head-on, outlining a plan to aggressively compete with rival SK Hynix in the race to develop and supply next-generation HBM technology.

HBM, a crucial component for high-performance computing and AI applications, has become a highly profitable segment for memory makers, shielded from the volatile supply and demand swings that often plague the broader memory market.

Samsung’s roadmap includes plans to begin supplying enhanced 12-layer HBM3E chips as early as the second quarter of this year and to produce cutting-edge HBM4 chips in the second half. HBM4 is widely expected to be integrated into Nvidia Corp.’s upcoming Rubin GPU architecture, making securing Nvidia’s approval and orders paramount.

Currently, SK Hynix is aggressively vying for the position of Nvidia’s primary supplier, recently announcing that it has already shipped the world’s first 12-layer HBM4 samples to major customers ahead of schedule.

Samsung’s path to Nvidia’s approval has been challenging. The company is reportedly revising its HBM3E chip design to meet Nvidia’s specifications. At the CES conference earlier this year, Nvidia CEO Jensen Huang acknowledged the need for a redesign, but expressed confidence in Samsung’s capabilities, stating, “They are working very fast. They’re very committed to do it.”

Beyond HBM3E and HBM4, Jun emphasized Samsung’s focus on custom chips as a key differentiator. He anticipates a strong memory market recovery in the coming quarters, fueled by robust AI and mobile demand, which he expects to significantly boost Samsung’s earnings in the second half of the year.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned