A Tokyo court has convicted a former judge of insider trading, adding to a series of recent financial scandals plaguing banks and the stock exchange in Japan, Bloomberg reports.

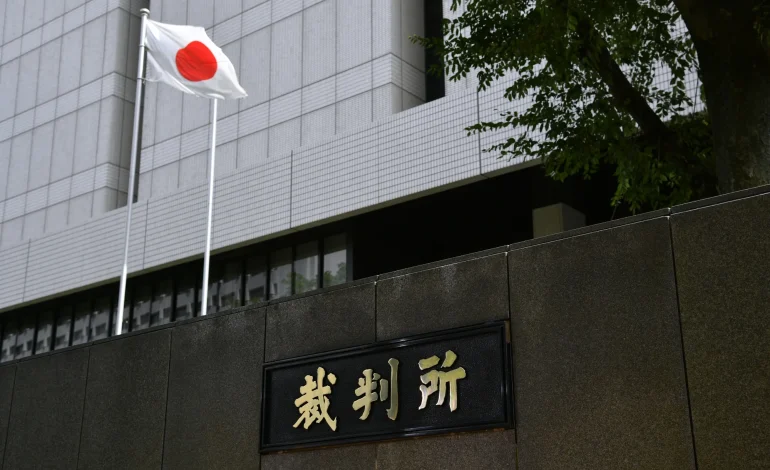

The Tokyo District Court sentenced Soichiro Sato to a two-year prison term, suspended, on Wednesday. According to a court spokeswoman, Sato was found guilty of utilizing confidential information he obtained during his tenure at the Financial Services Agency (FSA) last year to purchase stocks ahead of public tender offers.

At the time of the illegal activities, Sato, 32, worked within the FSA’s department responsible for reviewing and approving documents related to tender offers, reported Kyodo News.

This verdict comes amid a growing wave of scandals impacting Japan’s financial industry. On Monday, the Securities and Exchange Surveillance Commission (SESC) requested prosecutors to file charges against a former manager at Sumitomo Mitsui Trust Bank for insider trading.

Furthermore, in December, the SESC filed a complaint with prosecutors against a former Tokyo Stock Exchange employee and his father, alleging their involvement in insider trading activities.

In the case involving Sato, he used information gained during his time at the FSA to purchase shares of companies, including Mimasu Semiconductor Industry Co. According to a complaint filed by the SESC in December, Mimasu Semiconductor Industry Co.’s stock subsequently surged following the announcement of a tender offer by Shin-Etsu Chemical Co.

In addition to the suspended prison sentence, the court ordered Sato to pay a fine of ¥1 million (approximately $6,600 USD) and forfeit around ¥10.2 million in profits gained from the illegal transactions, according to the court spokeswoman.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned