Wealth Disparity in America: Top 0.1% Control Record Share, Bottom Half Struggles to Gain Ground

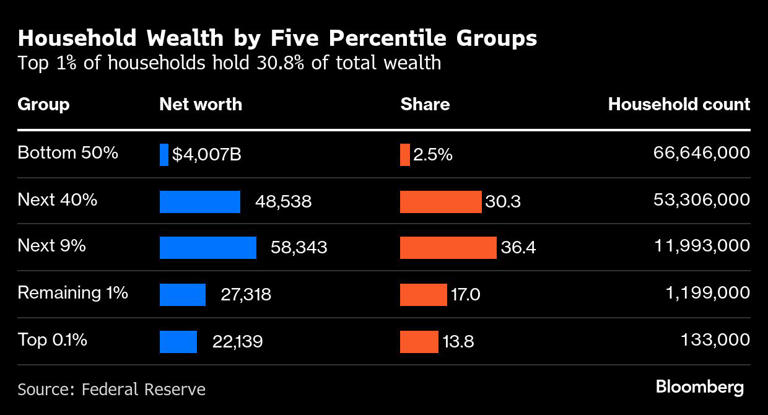

Wealth inequality in the United States remains stark, with the richest half of American families owning approximately 97.5% of the nation’s total wealth as of the end of 2024, while the bottom half holds just 2.5%, according to the latest data from the Federal Reserve, as per Bloomberg.

While the lower 50% of the wealth distribution saw a marginal improvement during President Joe Biden’s term, increasing their share from 2.2%, the gains pale in comparison to those at the very top. The 66.6 million households in this group collectively owned about $4 trillion in net wealth at the end of last year, an increase of $1.25 trillion over four years.

Over the same period, America’s wealthiest households – the 133,000 that comprise the top 0.1% – gained more than $6 trillion in net wealth. This wealth surge was primarily driven by significant increases in the value of corporate equities and mutual fund shares. This elite group holds roughly one-quarter of all US equities, representing nearly half of their total wealth, with approximately one-fifth held in private business holdings.

The top 0.1% expanded their share of total US wealth to a record 13.8% by the end of 2024, up from 13% in the same period of 2020. The bottom half’s share briefly climbed to 2.7% in mid-2022, the highest level recorded in Federal Reserve data dating back to 1989, before falling back to 2.5%.

The group experiencing a decline in their wealth share over the past four years is the affluent households comprising the 90th to 99th percentiles. These families witnessed a 2.4 percentage point decrease in their share of total wealth.

A notable trend accompanying the wealth gains at the top was a reduction in debt levels. The top 1% of households managed to decrease their net mortgage debt. Conversely, families lower down the economic scale added debt along with assets, including approximately $800 billion in high-interest consumer credit amassed over the four-year period.

The data also reveals a shift in wealth accumulation towards older households. Over the past four years, the wealth share held by individuals aged 70 and older increased by 3.8 percentage points, reaching 31.4% of the total. This demographic owns 38.3% of corporate equities, up from 32.9% in late 2020.

These trends are partly driven by demographic shifts, as the large Baby Boomer generation ages into their 70s. Individuals born before 1965 also own more than half of US real estate wealth. The Federal Reserve data paints a picture of increasing wealth consolidation at the top, while many American families struggle with rising debt and limited wealth accumulation.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned