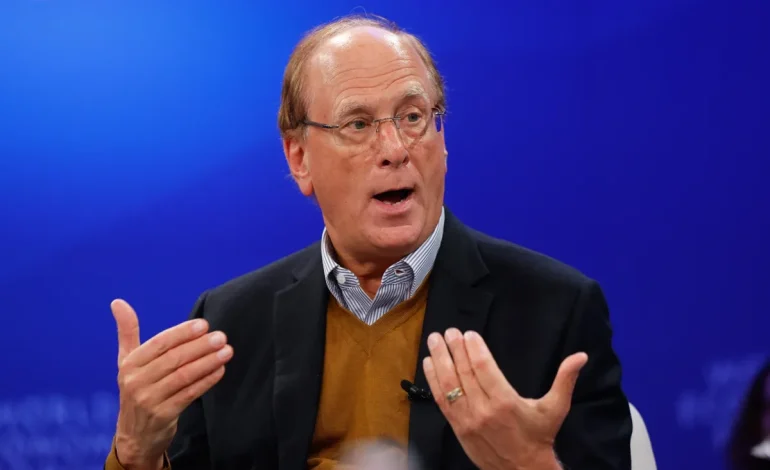

BlackRock CEO Larry Fink has raised concerns over the growing trend of protectionism worldwide, warning that such policies could hinder global trade and weaken economic growth.

In his annual letter to investors, Fink highlighted the increasing economic divide and its impact on politics and policy decisions.

Fink, who leads the world’s largest asset manager with over $11 trillion in assets, noted that many countries are experiencing “twin, inverted economies,” where wealth accumulates for some while economic hardship intensifies for others. He attributed this growing divide to shifts in trade policies, stating:

“Protectionism has returned with force.”

His comments come ahead of President Donald Trump’s planned imposition of new reciprocal tariffs on all countries, adding to existing tariffs on aluminum, steel, autos, and all Chinese goods. While the Trump administration views tariffs as a way to protect US industries from unfair competition, some economists warn they could escalate into a broader trade conflict, disrupting markets and slowing economic growth.

“I hear it from nearly every client, nearly every leader—nearly every person—I talk to: They’re more anxious about the economy than at any time in recent memory,” Fink wrote.

However, he also expressed confidence that economic challenges would be overcome, as they have been in the past.

Despite concerns over trade restrictions, Fink pointed to infrastructure and private credit as the fastest-growing areas of private markets. He noted that governments facing rising deficits are likely to turn to private investors to fund critical infrastructure projects. Similarly, businesses may increasingly seek funding from private markets rather than relying solely on traditional bank lending.

BlackRock has made significant investments in these sectors, acquiring HPS Investment Partners for $12 billion and Global Infrastructure Partners for $12.5 billion last year. The firm aims to make private market investments more accessible to a broader range of investors, moving beyond traditional stocks and bonds.

Fink also addressed broader economic shifts, warning that the US dollar’s position as the world’s reserve currency is not guaranteed indefinitely, especially if the country does not manage its debt. He noted the potential rise of digital assets, such as Bitcoin, as alternative stores of value.

Additionally, Fink emphasized the need for a balanced energy strategy, stating that renewable energy sources like wind and solar alone are not sufficient to meet rising global demand. He advocated for more investment in nuclear power and reforms to streamline energy infrastructure projects.

Fink suggested that traditional investment strategies may need to evolve, proposing a shift from the conventional 60/40 portfolio of stocks and bonds to a 50/30/20 model, incorporating private assets like real estate, infrastructure, and private credit. He argued that greater access to these markets could help more investors build long-term wealth.

As BlackRock continues to expand into private markets, Fink positioned the firm as a leader in shaping the future of investment strategies.

“We’ve been—first and foremost—a traditional asset manager,” he wrote. “That’s who we were at the start of 2024. But it’s not who we are anymore.”

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned