Chinese policymakers are reportedly considering a stimulus package to bolster the economy and stabilize markets in response to escalating trade tensions with the United States, triggered by President Trump’s recent tariff hikes, Bloomberg reports.

Discussions over the weekend focused on accelerating previously planned measures to stimulate domestic consumption and mitigate the impact of US tariffs, according to sources familiar with the matter.

High-level officials from various government entities, including financial regulators, convened to evaluate the situation and explore options for economic support. The potential measures under consideration include boosting consumer spending, incentivizing a higher birth rate, and providing subsidies for select exports. Regulators also reportedly discussed establishing a stabilization fund to support the Chinese stock market.

While the scale and timing of the potential stimulus are still being finalized and subject to change, officials reportedly believe China possesses sufficient tools to navigate the current economic uncertainties.

In a sign of commitment to market stability, Central Huijin Investment Ltd., an arm of China’s sovereign wealth fund, announced on Monday that it had increased its holdings in exchange-traded funds (ETFs) and pledged to continue buying to maintain market confidence.

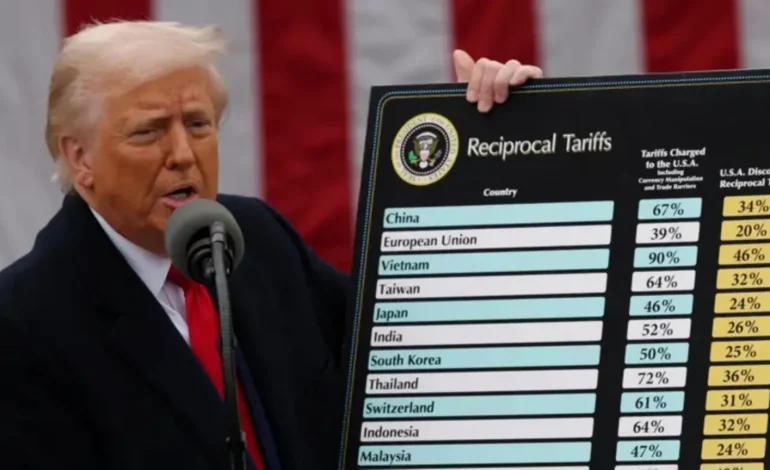

These discussions come as Beijing prepares for the broader repercussions of the intensifying trade conflict with the US. Last Friday, China announced a 34% tariff on all imports from the US, effective April 10, mirroring the level of Trump’s reciprocal tariffs on Chinese goods. Beijing also unveiled additional countermeasures, including immediate restrictions on exports of seven types of rare earths.

The escalating trade war has already impacted global markets, with a key index of Chinese shares listed in Hong Kong plunging by over 12% on Monday, heading towards a correction. The onshore CSI 300 Index also experienced a significant drop of over 7%.

Responding to the pressure, the People’s Daily, the flagship newspaper of the Communist Party, published a front-page commentary on Monday stating that China has room to ease borrowing costs and reserve requirements for lenders to defend its economy.

The official Xinhua News Agency echoed this sentiment on Saturday, declaring that Beijing will continue to take “resolute measures” to safeguard its sovereignty, security, and other interests.

The US tariffs announced last week could raise levies on nearly all Chinese products to at least 54%, potentially crippling exports to the US just as China’s economy is showing signs of stabilizing at the start of 2025.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned