Delta Air Lines has revised its expectations for the remainder of the year, citing weakening bookings tied to shifting trade policies under the Trump administration.

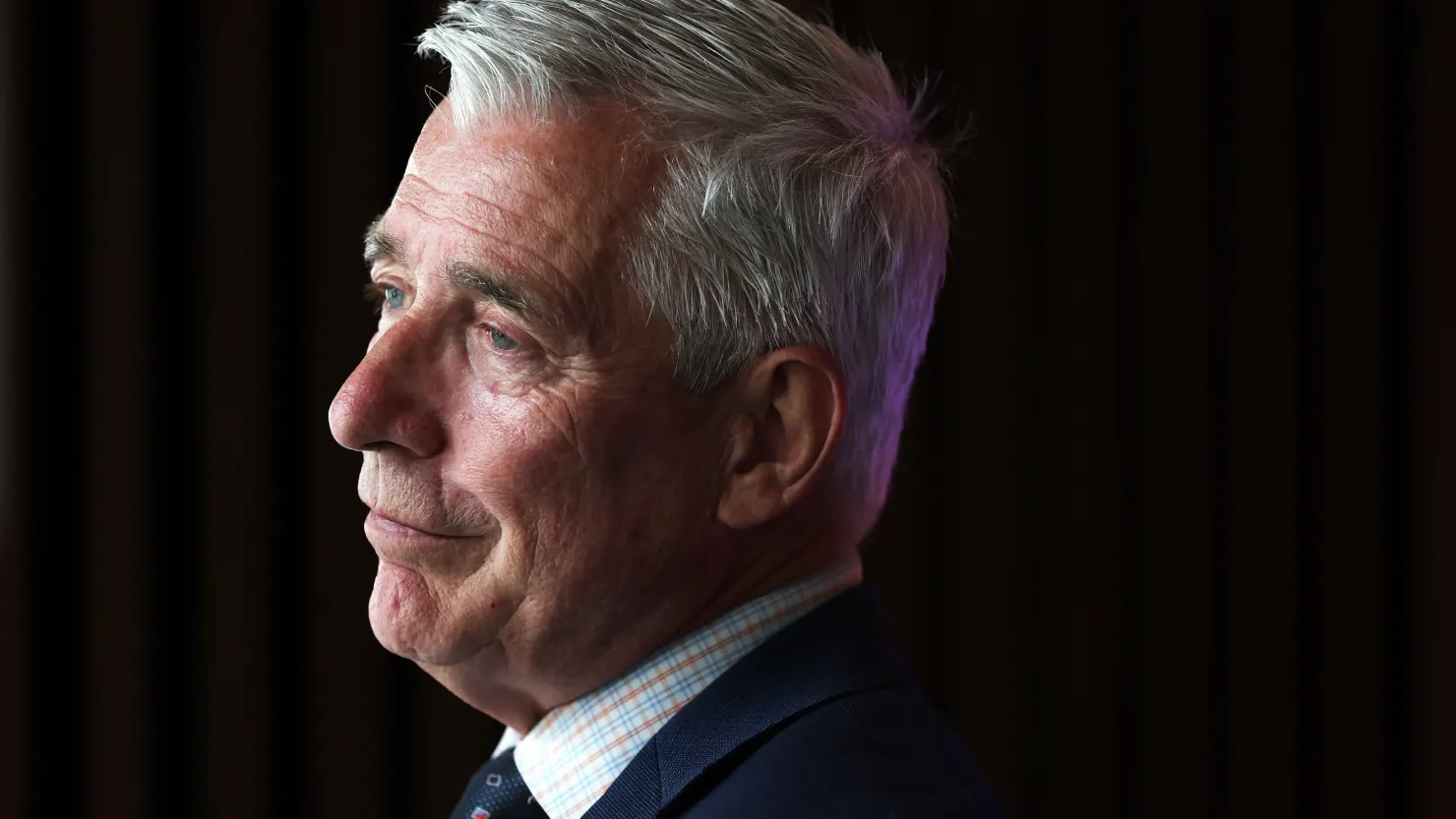

CEO Ed Bastian noted that the airline would not expand its flying capacity in the second half of 2025 as initially planned, opting instead for flat capacity growth due to sluggish demand, especially in the face of broad economic uncertainty.

In an announcement on Wednesday, Delta adjusted its second-quarter revenue forecast, predicting it could decline by up to 2%, or grow by as much as 2%, compared to last year. Wall Street had anticipated a 1.9% increase. Additionally, the airline adjusted its earnings per share estimate for the second quarter to a range of $1.70 to $2.30, falling short of analysts’ expectations, which had been set at $2.23 per share.

Delta’s revised outlook marks a significant shift for the airline, which had previously projected strong demand for the year. Just a month ago, Bastian had forecasted 2025 to be the company’s best financial year. However, his outlook has darkened, driven by concerns over the impact of President Trump’s tariffs and trade policies on consumer and corporate spending. Bastian highlighted a reduction in both corporate and leisure travel demand since mid-February, contributing to a slowdown in bookings.

Despite the broader weakness, Delta reported positive results for the first quarter, with net income increasing to $240 million from $37 million last year. Revenue for the period rose 2% to $14.04 billion, meeting Wall Street expectations. However, the airline’s stock price was down 41% year-to-date, reflecting investor concerns over the broader economic environment, including the uncertainties surrounding trade and tariffs.

Delta’s capacity for the second half of the year was initially projected to grow by 3-4%, but now the airline expects no growth in capacity for the remainder of 2025. Analysts anticipate other major US carriers to make similar adjustments in the coming weeks.

Bastian emphasized that while overall demand for travel remained strong at the start of the year, the outlook has changed due to slowing consumer confidence and the broader economic impact of the US trade policies. The airline’s focus for now will be on protecting margins and cash flow while adjusting its business strategy in response to the current economic conditions.

This cautious stance has led Delta to withdraw its 2025 financial guidance. The airline had previously projected strong profit growth for the year, but now sees the situation as more uncertain due to the ongoing trade tensions. Delta has refrained from providing an updated forecast for 2025, as it navigates the economic turbulence resulting from President Trump’s shifting trade policies.

The airline also noted that it expects international and premium travel segments to remain relatively strong, while demand for main cabin bookings, which are more sensitive to economic conditions, has weakened. Bastian’s statements reflect growing concerns among CEOs of various sectors, particularly airlines, about the prolonged effects of the trade war on business confidence and consumer spending.

With input from CNBC, CNN, and the Associated Press.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned