Understanding Tariffs and Trump’s Trade Strategy

The latest round of tariffs imposed by US President Donald Trump has taken effect, impacting imports from 60 countries.

These tariffs, ranging from 20% to 104%, are part of Trump’s broader effort to reshape international trade. While he argues that tariffs will boost the US economy and protect jobs, critics warn that they could increase consumer prices and disrupt the global economy.

Tariffs are taxes imposed on goods imported from other countries. They are typically calculated as a percentage of the product’s value. For example, a 25% tariff on a $10 item would add $2.50 to its cost. In the case of the new 104% tariff on Chinese imports, a $10 item would now carry an additional $10.40 in taxes.

Businesses that import these goods must pay the tariff to the US government, often passing the cost on to consumers in the form of higher prices.

Trump has long advocated for the use of tariffs to strengthen the US economy. He argues that they encourage Americans to buy domestically made products, generate tax revenue, and attract investment in US manufacturing.

A major goal of Trump’s tariff policy is to reduce the US trade deficit—the gap between what the country imports and exports. He contends that other nations have taken advantage of the US through unfair trade practices and that tariffs are a way to level the playing field.

Additionally, tariffs have been used as a negotiation tool. Trump’s initial tariffs targeted China, Mexico, and Canada, with demands for stricter immigration enforcement and measures against illegal drug trafficking.

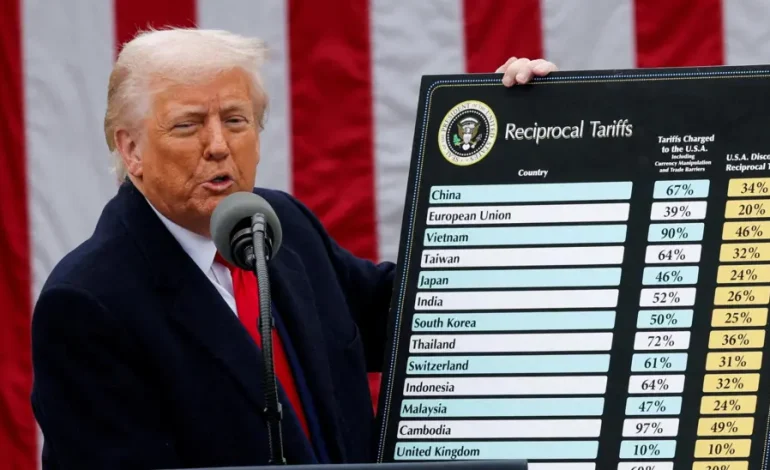

The new tariffs include:

A minimum 10% charge on all imports to the US.

Higher tariffs on specific countries, such as 46% on Vietnamese imports and 20% on EU goods.

A significant 104% tariff on Chinese imports, following retaliatory tariffs from China.

While the Trump administration describes these as “reciprocal tariffs,” meaning they match foreign tariffs on US goods, some calculations appear to be based on closing the trade deficit rather than direct reciprocity.

Economists predict that tariffs could lead to:

Higher prices: Companies may pass increased costs to consumers, affecting everything from clothing and electronics to automobiles.

Market volatility: Stock markets have reacted negatively, reflecting investor concerns over increased costs and reduced corporate profits.

Slower economic growth: Some analysts believe tariffs could push the US toward recession, with businesses hesitant to make long-term investments amid trade uncertainty.

Countries affected by the tariffs have responded with criticism and countermeasures:

The European Union and Japan expressed concerns about potential trade war consequences.

Canada imposed retaliatory tariffs on certain US vehicles.

The UK government is considering its own countermeasures, despite ongoing trade negotiations with the US.

BBC and the Financial Times contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned