France is pushing for the European Union to accelerate its efforts to streamline financial regulations and protect the competitiveness of its banking sector in the face of deregulation moves in the UK and US, Bloomberg reports.

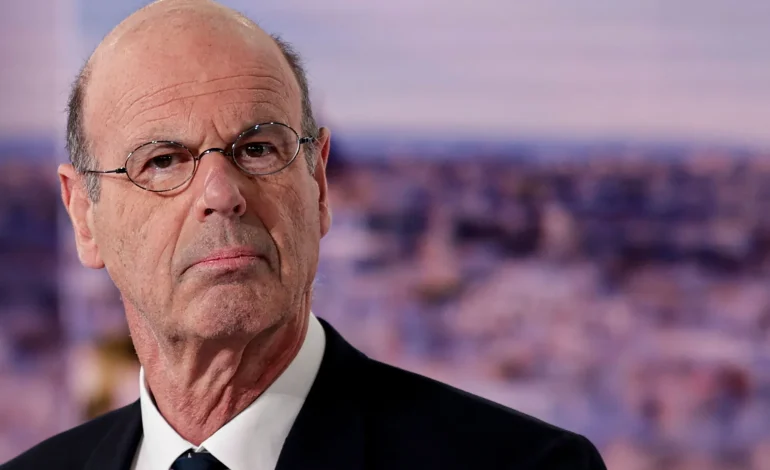

French Finance Minister Eric Lombard issued a call to action, urging the EU to “quickly adapt to any regulatory rollback” from its key rivals.

France has been a leading voice in advocating for easing the regulatory burden on European banks through simplification. It was instrumental in convincing the EU to expedite a comprehensive review of the industry’s competitiveness, bringing it forward by two years.

However, the review is still not expected to conclude until the end of 2026. This timeline has drawn criticism from within EU policy and regulatory circles, who privately express concern over the slow pace compared to the rapid deregulation and revision happening in the UK and US.

The EU is already consulting on options for implementing the market risk framework, scheduled to take effect in 2026. However, the UK has delayed its adoption until 2027, citing uncertainty surrounding US implementation. France is advocating for the EU to follow suit.

Lombard also highlighted the “important drag on competitiveness” stemming from the fragmentation of the European banking sector. He specifically pointed to liquidity and capital rules for pan-European banks as a key contributing factor.

The push from France reflects growing anxiety within the EU about the potential for its banking sector to fall behind its global competitors if it doesn’t move quickly to address regulatory burdens. The coming months will be crucial as the EU navigates the complex task of balancing financial stability with the need for a competitive banking landscape.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned