Global stock markets advanced on Monday, buoyed by a rally in technology shares after the United States announced a temporary exemption from new tariffs on a range of consumer electronics.

The move, announced by President Donald Trump, provided short-term relief to a sector that has been under intense pressure from trade policy uncertainty.

The White House stated that smartphones, laptops, semiconductors, and other electronic goods would be excluded from the latest round of “reciprocal” tariffs, which are part of a broader effort to rebalance trade terms with China and other countries. The exemption, however, remains temporary, with further tariff decisions expected in the coming weeks.

European indices reflected strong early-session gains. Germany’s DAX rose by 2.4% to 20,857.54, France’s CAC 40 gained 2% to 7,245.28, and the UK’s FTSE 100 advanced 1.8% to 8,104.83. Futures for US indices also pointed higher, with the S&P 500 up 1.2%, and the Dow Jones Industrial Average gaining 0.9%. Nasdaq futures jumped 1.8%, propelled by tech enthusiasm.

Asian markets also posted solid gains. Japan’s Nikkei 225 climbed 1.2% to 33,982.36, while South Korea’s Kospi added 1% to 2,455.89. Hong Kong’s Hang Seng led regional advances with a 2.4% gain, and China’s Shanghai Composite added 0.8% following data showing a 12.4% year-over-year jump in Chinese exports in March.

Australia’s S&P/ASX 200 closed 1.3% higher, while Taiwan’s Taiex dipped 0.1%, as chipmakers in the region await details on future US tariffs targeting semiconductors.

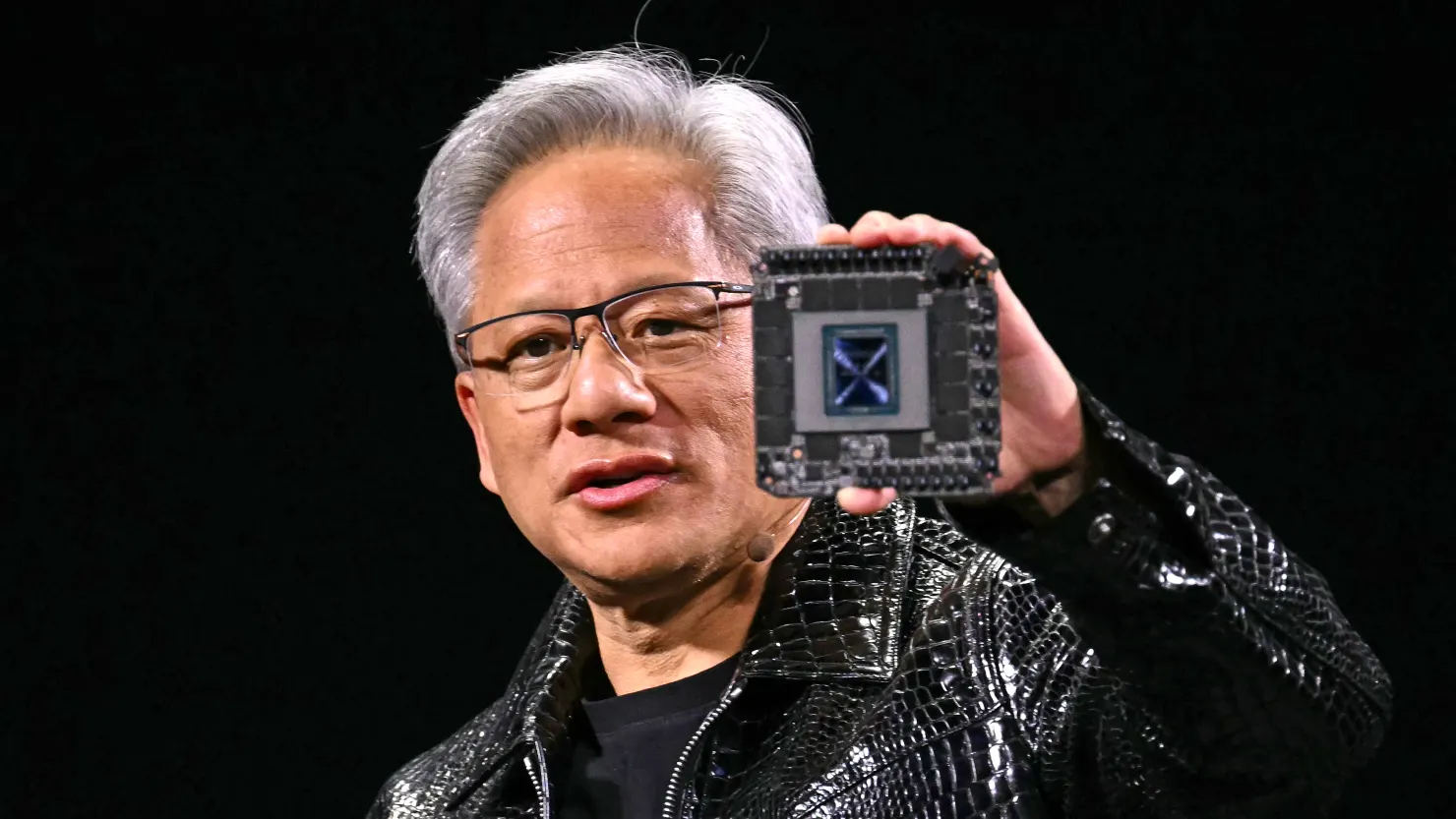

Technology shares rallied in response to the exemption. In Tokyo, Tokyo Electron rose 1.4%, while Advantest surged 4.9%. South Korea’s Samsung Electronics gained 1.8%. In US premarket trading, Apple shares rose over 6%, and Nvidia climbed 2%. The Technology Select Sector SPDR Fund (XLK) traded 2.1% higher ahead of the opening bell.

Analysts noted the decision significantly benefits US tech companies heavily reliant on components manufactured in China. However, the administration emphasized that these products remain subject to other existing tariffs, maintaining a level of uncertainty in the sector.

Despite Monday’s rally, broader concerns remain. President Trump indicated that semiconductors could still face new duties soon, and the exemption on phones may also be reconsidered. Market volatility has remained high, with last week seeing one of the most turbulent stretches in recent memory. The CBOE Volatility Index spiked above 50 on Thursday before calming somewhat by the week’s end.

Analysts say while the tech reprieve supports short-term sentiment, the erratic nature of trade policy continues to weigh on investor confidence. Dan Ives, an analyst at Wedbush, described the move as “the right step” but cautioned that “mass uncertainty” remains about the path forward.

US bond yields, which spiked last week, remained elevated early Monday. The 10-year Treasury yield stood at 4.46%, slightly down from Friday’s highs but well above levels from a week earlier. The dollar weakened against major currencies, falling to 143.25 yen and $1.1382 per euro, as some investors moved out of US assets amid policy unpredictability.

Gold prices dipped slightly to $3,223 an ounce after hitting record highs earlier in the day, while oil markets saw modest gains. Brent crude rose to $64.96 per barrel, and US benchmark crude reached $62.13.

With input from CNBC, the Associated Press, Reuters, and Bloomberg.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned