Global stock markets rose on Tuesday as investors responded positively to signs of easing trade tensions following comments from US President Donald Trump suggesting a temporary reprieve on some tariffs and a potential pause in levies on auto imports.

The gains were led by European benchmarks, with Germany’s DAX jumping 1.5% to 21,277.44 and Britain’s FTSE 100 advancing 1.0% to 8,215.51. France’s CAC 40 also climbed, adding 0.6% to reach 7,316.09. US futures followed suit, with contracts for the S&P 500 and Dow Jones Industrial Average gaining 0.3% and 0.2%, respectively.

In Asia, Japan’s Nikkei 225 gained 0.8% to close at 34,267.54, buoyed by strong performances from automakers such as Toyota and Honda, which rose 3.7% and 3.6%, respectively. South Korea’s Kospi advanced 0.9%, while Australia’s ASX 200 added 0.2%. Chinese shares were more subdued, with the Shanghai Composite and Hong Kong’s Hang Seng each edging up 0.2%.

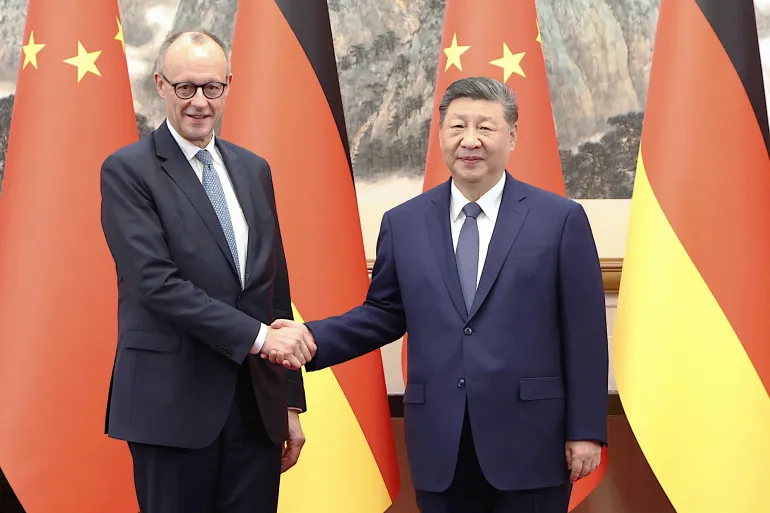

The broader market rally came after Trump announced exemptions for electronics such as smartphones and computers from newly imposed tariffs. These moves, though possibly temporary, raised hopes for potential negotiations in the ongoing trade conflict with China. Trump also hinted at a short-term relief for the auto sector, telling reporters he was “looking at something to help some of the car companies.”

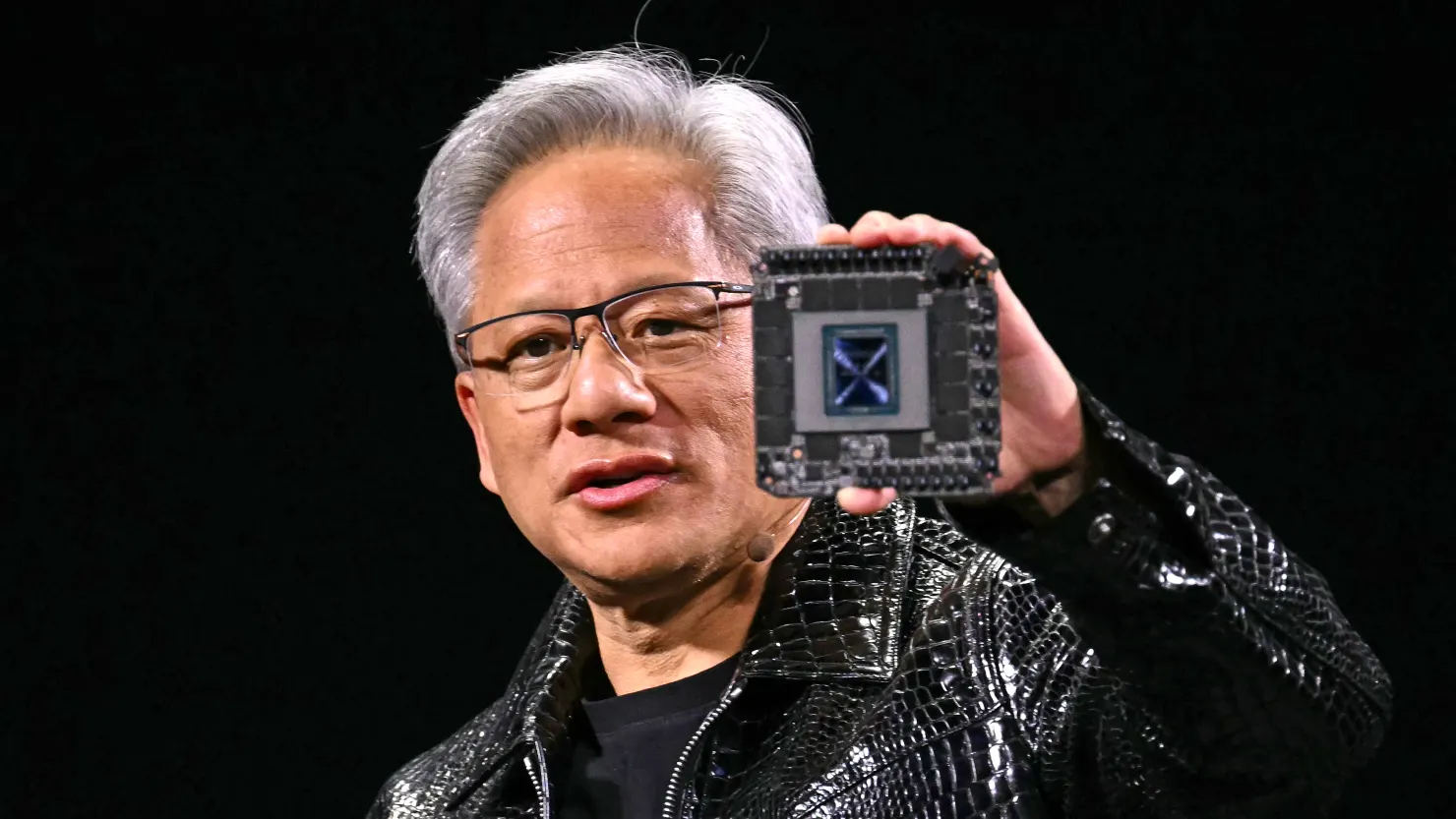

Despite the upbeat tone, the US administration simultaneously launched investigations into the national security implications of importing computer chips, pharmaceuticals, and related products—signaling that new tariffs could still be on the horizon.

Markets appear to be navigating a fragile balance. Analysts noted that while the softening stance may suggest a de-escalation, uncertainty remains high due to the unpredictable nature of US trade policy.

“You’ve got a near daily change in rhetoric out of the US that makes positioning quite difficult,” said Christina Woon of Eastspring Investments.

On Wall Street, Monday’s session reflected similar optimism, with the S&P 500, Dow, and Nasdaq each gaining around 0.6–0.8%, driven by strength in technology stocks, including Apple.

Elsewhere, commodity and currency markets showed more modest moves. Oil prices were little changed, with US crude at $61.51 per barrel and Brent at $64.85. Gold rose 0.5% to $3,227.09 an ounce, nearing record highs amid persistent demand for safe-haven assets.

In currencies, the US dollar slipped slightly to 142.75 yen, while the euro remained steady at $1.1351.

With input from Bloomberg, the Wall Street Journal, and the Associated Press.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned