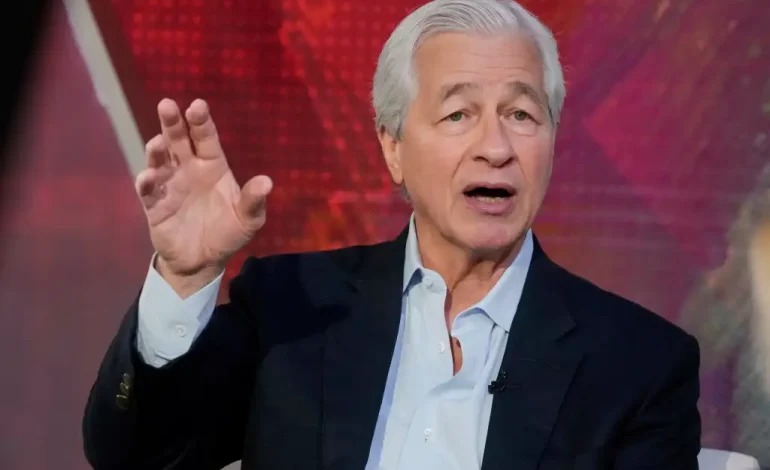

JPMorgan Chase Chairman and CEO Jamie Dimon has sold approximately $31.5 million worth of the bank’s stock, according to a regulatory filing released Monday, New York Post reports.

The move marks the latest in a series of share sales by Dimon, who began selling stock last year for the first time since taking over as CEO in 2005.

The filing indicates Dimon sold 133,639 shares. JPMorgan stock closed at $234.72 on the day of the filing, representing a 0.6% decline.

Dimon’s sale comes shortly after JPMorgan, the largest US bank by assets, reported stronger-than-expected first-quarter earnings, driven by record equity trading revenue and increased activity in debt underwriting and merger advisory services.

Now in his 19th year at the helm, Dimon is considered one of the most influential leaders in global finance. At age 69, he has acknowledged that succession planning is a top priority for the bank. JPMorgan’s board has echoed that sentiment, indicating that preparations are underway for a future leadership transition.

Dimon’s total compensation rose 8.3% this year, bringing his 2024 pay package to $39 million.

In his most recent letter to shareholders, Dimon expressed concern about the long-term impacts of global trade tensions, including the potential for sustained inflation and increasing fiscal deficits—issues that could shape economic and market conditions in the years ahead.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned