Boeing shares declined 2.4% on Tuesday following reports that Chinese authorities have instructed domestic airlines to halt purchases of Boeing aircraft and parts, as trade tensions between the United States and China continue to escalate.

According to Bloomberg, China Southern Airlines suspended plans to replace 10 of its Boeing 787-8 Dreamliner jets, citing “matters affecting the property transaction” in a regulatory filing. The decision comes amid increasing geopolitical friction and new tariff measures between the two countries.

Although the specific reason behind the airline’s reversal remains unclear, the change follows the imposition of a 125% tariff on American aircraft imports by China, a retaliatory move after the US implemented a 145% levy on Chinese goods. The elevated costs could have made new purchases from Boeing financially unviable.

The development is a potential setback for Boeing, which considers China a major market for its commercial aircraft business. In its most recent annual report, the company noted that its future performance could be affected by “deterioration in geopolitical or trade relations.” Boeing also warned that limitations on deliveries to Chinese customers could result in reduced market share.

The latest disruption adds to a challenging period for the US aerospace manufacturer, which has faced production delays, legal scrutiny, and labor disputes in recent years. While Boeing did not immediately respond to a request for comment, the company’s stock is down about 12% year-to-date.

President Donald Trump addressed the matter on his social media platform, saying China had “reneged on the big Boeing deal,” though he did not provide specifics on the agreement he was referencing.

Chinese state-owned carriers, including China Southern, Air China, and China Eastern, are among the largest airline operators globally. If the current pause continues, industry analysts say it could benefit Boeing’s European competitor, Airbus, or boost demand for emerging domestic aircraft manufacturers in China.

“There’s potential for Airbus to gain a structural advantage in the Chinese market if this continues,” wrote Ronald J. Epstein, an aerospace analyst at Bank of America.

However, he added that China may face limits in sustaining such a halt, noting that domestic production capacity remains constrained and Airbus may not be able to scale up quickly enough to meet the country’s long-term demand.

Bank of America estimates that Chinese airlines had planned to buy 29 Boeing aircraft in 2025. While the impact of paused deliveries may be manageable in the short term—given Boeing’s existing backlog—analysts caution that prolonged restrictions could influence the company’s strategic positioning in one of the world’s fastest-growing aviation markets.

Ryanair and Delta have also signaled they may delay upcoming Boeing deliveries if tariffs increase costs. Ryanair CEO Michael O’Leary recently told the Financial Times that “common sense” may eventually lead to a resolution but suggested that timing remains uncertain.

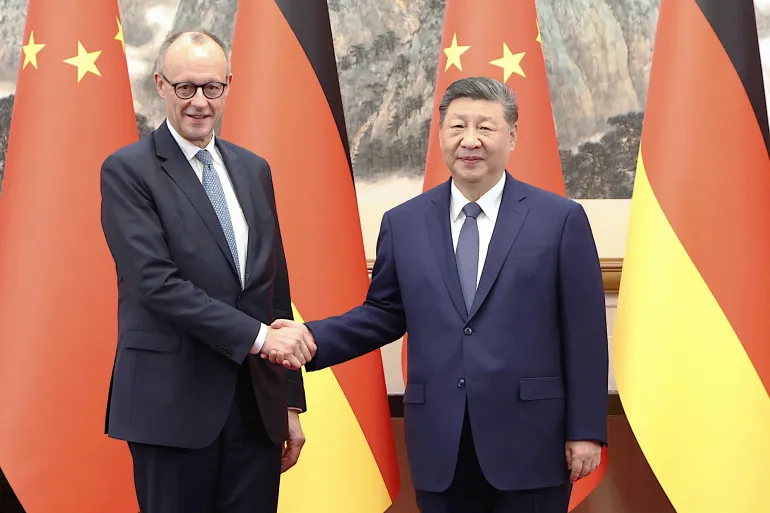

Speaking at a trade forum this week, Chinese President Xi Jinping emphasized the importance of maintaining global trade stability and open international cooperation, signaling a desire to ease tensions without directly referencing the aircraft dispute.

Business Insider and Axios contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned