As tensions rise in the ongoing US-China trade dispute, a new front has emerged on American TikTok feeds.

Chinese manufacturers are taking to the platform in increasing numbers, promoting what they claim are direct-from-factory luxury goods at steep discounts—raising questions about authenticity, supply chain transparency, and the effectiveness of new tariffs.

Viral TikTok videos have showcased influencers and self-proclaimed suppliers offering unbranded versions of popular luxury items, such as handbags and activewear, at a fraction of the retail cost. One such video, now removed, featured a user named Wang Sen claiming to manufacture products for top brands while standing in front of what appeared to be Hermès-style handbags.

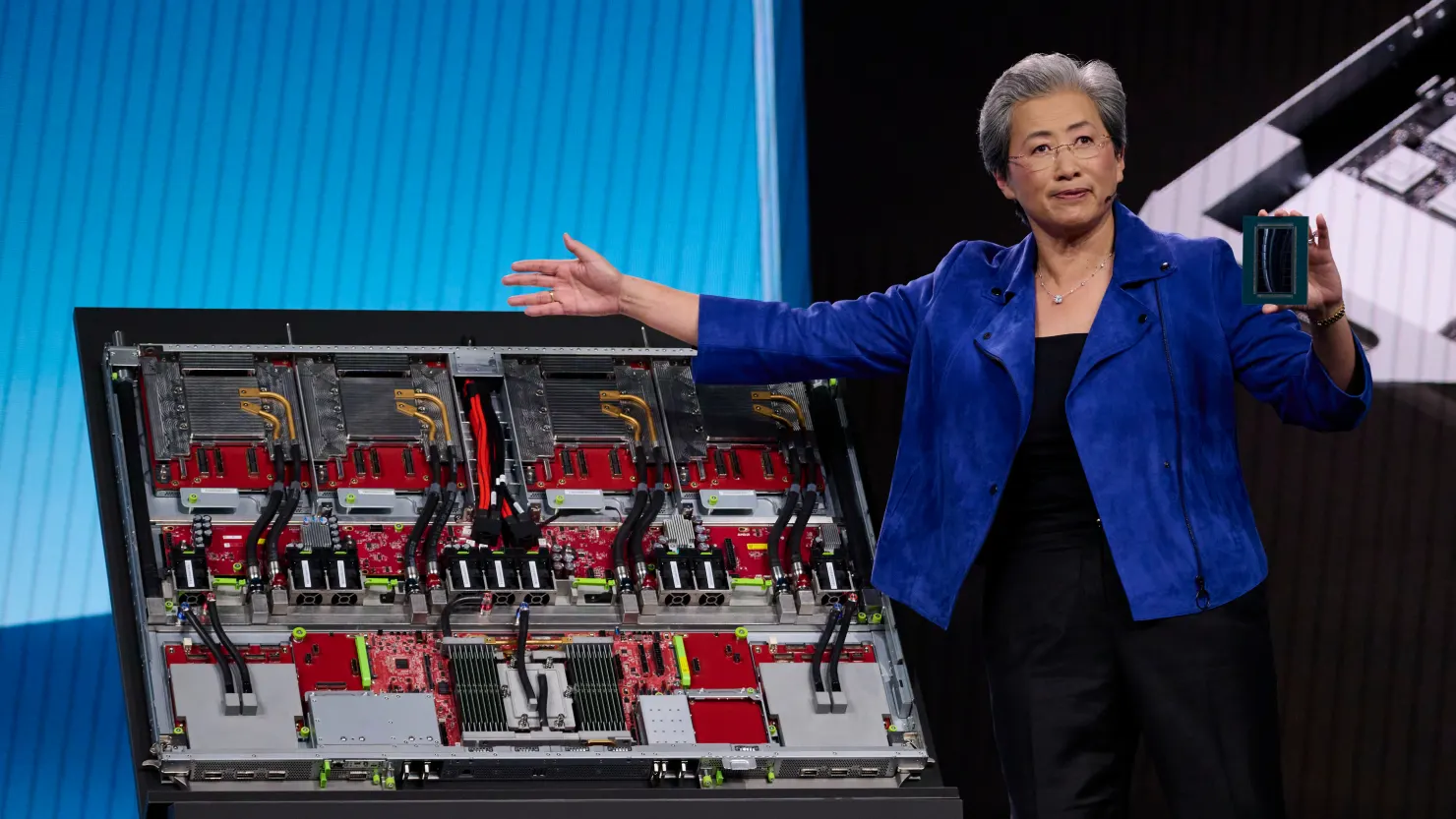

The surge in interest has propelled Chinese e-commerce apps into the spotlight. DHgate, a platform linking global buyers to Chinese factories, rose to the second spot in the US Apple App Store this week. Another Chinese app, Taobao, also entered the top ten. Many of these videos include links or contact information, encouraging direct purchases from suppliers.

However, industry experts urge caution. Claims of being original equipment manufacturers (OEMs) for major brands like Lululemon and Chanel are largely unverified.

“It’s highly improbable that legitimate brand suppliers would publicly market these products,” said Hao Dong, a senior lecturer at the University of Southampton.

Manufacturers typically operate under strict non-disclosure agreements and are contractually prohibited from revealing their partnerships or selling branded products independently.

Lululemon has publicly denied working with factories mentioned in the viral TikToks, cautioning consumers about counterfeit goods and misinformation. The company confirmed that the suppliers in question are not listed in its most recent supplier disclosure, and reiterated its commitment to quality control and authorized distribution channels.

Beyond questions of authenticity, these videos are drawing attention to deeper issues in the global economy. Shoppers are being forced to reckon with where their favorite products actually come from—and how much their cost is tied to complex international supply chains.

“If China stopped producing, our shops would be empty,” said Regina Frei, a professor at University of the Arts London.

There are environmental concerns as well. The rise of fast, direct-to-consumer shipping—fueled by platforms like Shein, Temu, and now DHgate—has led to a sharp increase in carbon emissions from global freight and packaging waste. Frei referred to the trend as “an environmental disaster,” noting that many of these goods are cheaply made and frequently discarded.

It also remains unclear whether consumers can bypass President Donald Trump’s proposed 145% tariffs by purchasing directly from Chinese suppliers. While some viral posts claim dramatic savings even after import duties, upcoming policy changes—including the expected end of the de minimis exemption for packages under $800—could close that loophole and raise prices on imported goods.

DHgate, which has pledged to support sellers with a “Tariff Escort Plan” including subsidies and logistical help, says it now hosts over 2.6 million registered suppliers and ships to more than 200 countries. Its founder, Wang Shutong, has been called the “female Jack Ma” for her role in building one of China’s largest cross-border e-commerce platforms.

As the trade war increasingly plays out online, experts warn that consumers should remain vigilant.

“Just because a product looks identical doesn’t mean it meets the same standards,” Dong noted. “There are risks—not just to your wallet, but to your safety and data, too.”

CNN, the Wall Street Journal, and Bloomberg contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned