Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, reported stronger-than-expected earnings for the first quarter of 2025 and reaffirmed its annual revenue growth forecast, even as it faces growing trade policy uncertainties stemming from the United States.

The company posted a net income of NT$361.56 billion (approximately $11 billion), up 60.3% from the same period last year, while revenue surged 41.6% to NT$839.25 billion. Both figures exceeded analyst expectations, with Visible Alpha having forecast a profit of NT$354 billion and revenue of NT$836 billion.

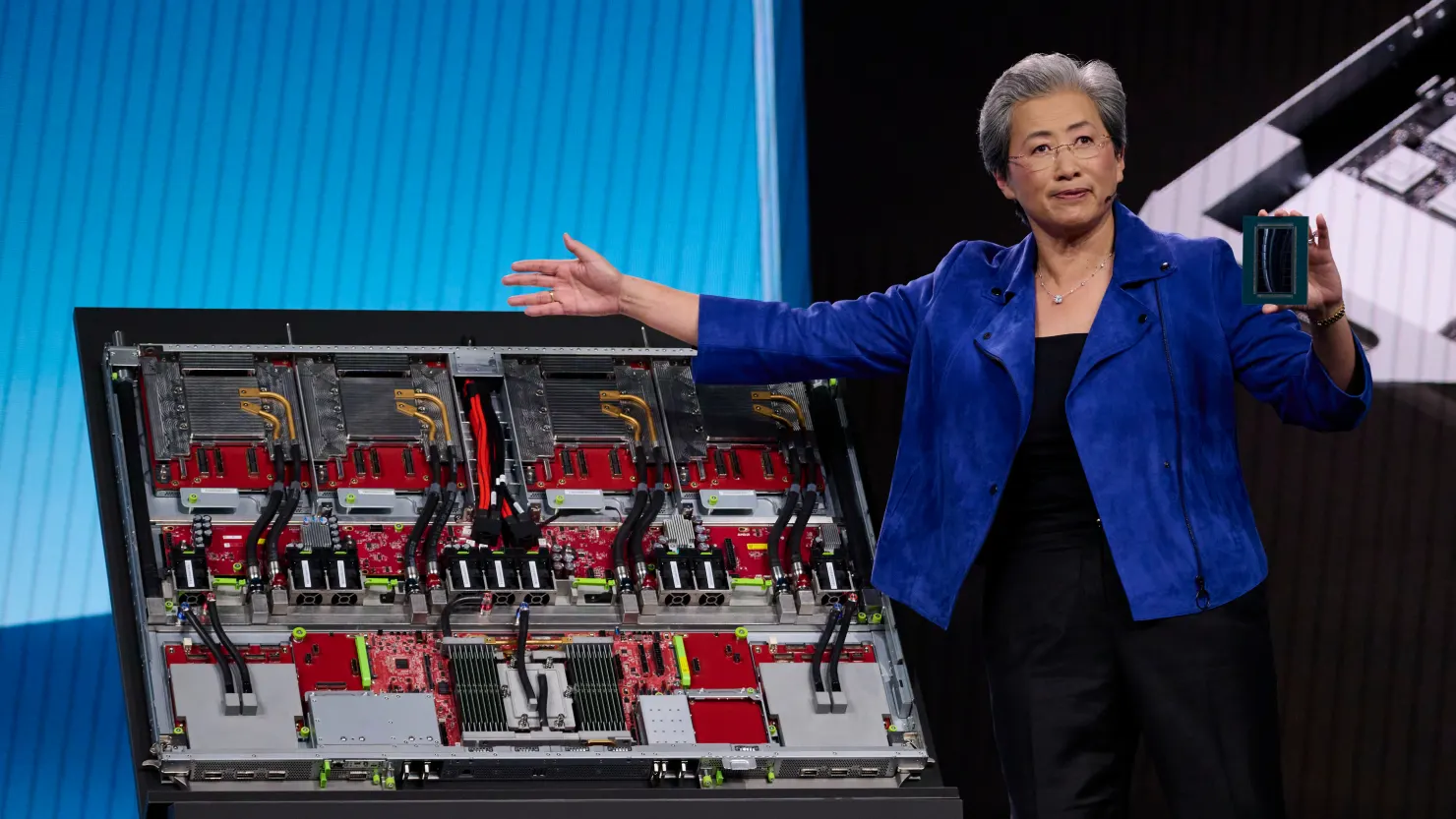

Driving the earnings performance was a continued surge in demand for high-performance computing chips, including those used in artificial intelligence (AI) and 5G applications. This segment, which includes clients such as Nvidia and AMD, accounted for 59% of TSMC’s total revenue in the quarter.

Advanced semiconductor technologies — specifically 7-nanometer nodes and below — contributed 73% of total wafer revenue. TSMC noted that growth was particularly robust in its 3-nanometer and 5-nanometer lines, which are key to the next generation of AI and mobile processing.

“Moving into the second quarter of 2025, we expect our business to be supported by strong growth of our 3-nanometer and 5-nanometer technologies,” said CEO C.C. Wei during the earnings call.

The company is guiding second-quarter revenue in the range of $28.4 billion to $29.2 billion, which translates to NT$936 billion at current exchange rates — above analyst expectations of NT$881 billion.

Despite the positive earnings, TSMC shares have faced significant pressure this year. Taiwan-listed shares are down more than 20% year-to-date, while US-listed shares have declined 23%. Analysts attribute the decline in part to investor concerns over geopolitical risks and ongoing trade disputes.

The administration of US President Donald Trump has introduced sweeping trade tariffs and stricter export controls, some of which target Taiwan and TSMC’s major clients. Currently, Taiwan is subject to a 10% blanket tariff that could rise to 32% pending the outcome of ongoing negotiations. Export controls on AI chips — initially proposed under the Biden administration and expanded under Trump — have already impacted firms like Nvidia and could further restrict semiconductor sales through TSMC foundries.

Despite these concerns, TSMC’s leadership stated they have not observed changes in customer behavior so far.

“We understand there are uncertainties and risks from the potential impact of tariff policies,” CFO Wendell Huang said in a statement.

Huang added that the company would continue to monitor the situation closely.

In response to rising geopolitical tensions and in a bid to diversify its supply chain, TSMC last month announced an additional $100 billion investment in the US, building on the $65 billion already committed toward three manufacturing plants. The company clarified, however, that it is not pursuing joint ventures or technology-sharing agreements with other firms, including Intel, countering recent speculation.

Meanwhile, TSMC’s Arizona facilities have begun production of advanced chips for US clients. AMD and Nvidia confirmed this week that new processors are being manufactured at the site, with Nvidia planning to produce as much as half a trillion dollars’ worth of AI infrastructure in the US over the next four years.

Despite strong financial results and efforts to expand manufacturing capacity abroad, TSMC continues to face broader investor uncertainty. Market analysts say that how the company navigates trade negotiations, manages geopolitical tensions, and sustains demand in the AI sector will be key to maintaining momentum throughout the year.

TSMC is targeting revenue growth in the “mid-20%” range for 2025 — a figure the company is sticking with, even amid shifting trade dynamics and broader industry caution.

With input from CNBC, Market Watch, and Reuters.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned