The Japanese yen weakened against major G-10 and Asian currencies early Thursday following reports that this week’s US-Japan tariff discussions did not address foreign exchange issues.

The omission appeared to ease immediate concerns that the US, under former President Donald Trump’s influence, might target Japan’s currency policies.

The yen’s retreat pushed the dollar/yen pair up 0.6% to 142.76, while the Australian dollar also gained 0.5% against the yen to reach 90.80. Analysts say the absence of foreign exchange matters from the agenda gave traders more confidence that Japan would avoid scrutiny over its currency stance, at least for now.

Vishnu Varathan, Head of Macro Strategy for Asia ex-Japan at Mizuho Securities Singapore, noted in an email that while Japan appears to be making “great progress” in negotiations, trade uncertainty remains high. “More volatility is likely,” he added, as markets speculate on binary outcomes—either a trade deal or a collapse in talks.

Asian markets reflected cautious optimism. Japan’s Nikkei rose 0.7%, bolstered by both the weaker yen and hopes surrounding trade discussions. US President Trump made a surprise appearance at the talks, proclaiming “big progress” alongside Japanese negotiator Ryosei Akazawa.

Charu Chanana, Chief Investment Strategist at Saxo, said investors are beginning to shift from fear to cautious hope as negotiations resume.

“When expectations are low, even talks about talks can buoy markets,” she said.

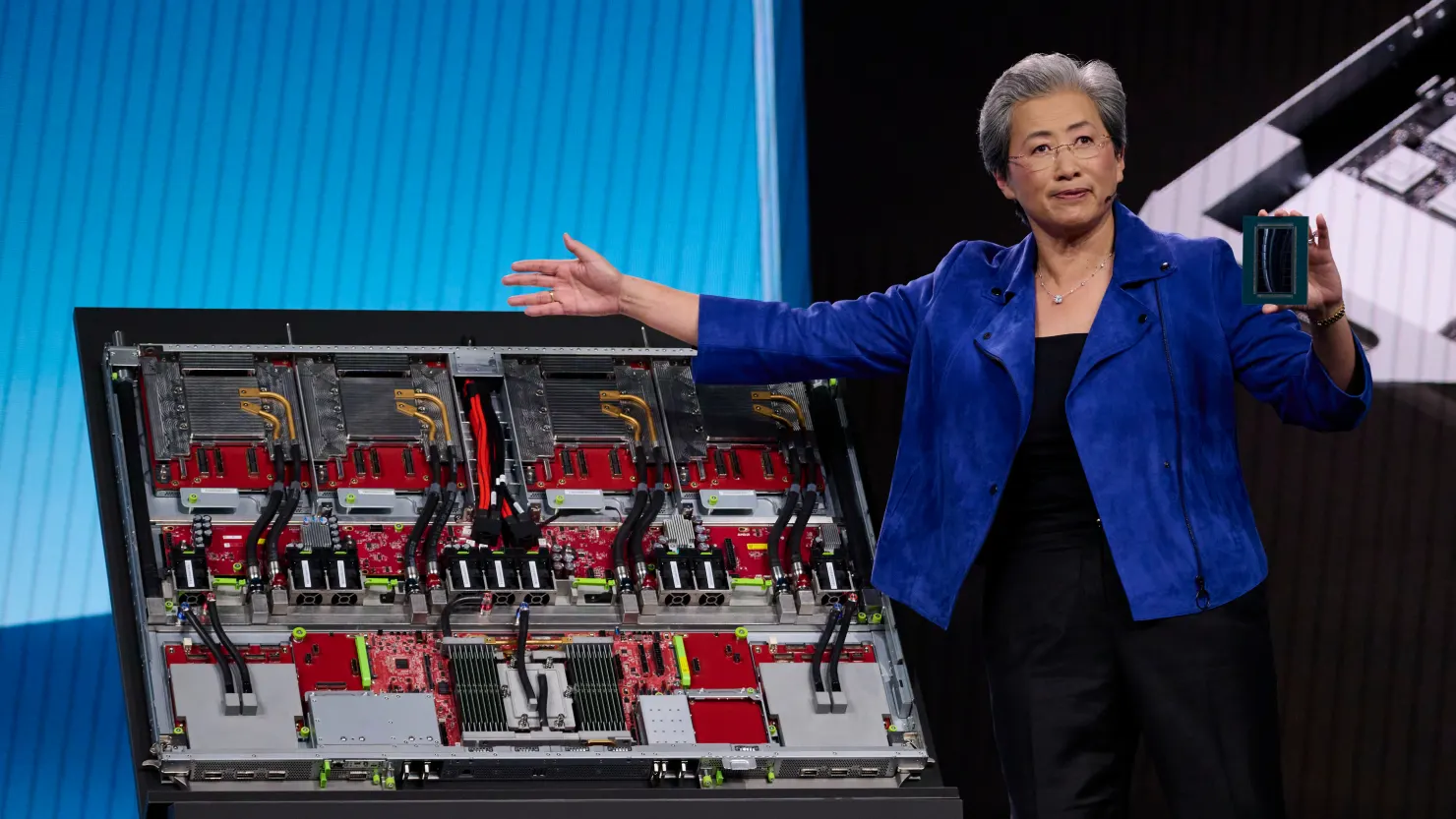

Elsewhere, global markets continued to digest trade-related uncertainty. Technology shares remained in focus after recent earnings warnings from chipmakers Nvidia and ASML. All eyes are now on Taiwan Semiconductor Manufacturing Co. (TSMC), which is set to report its earnings amid heightened scrutiny of the global semiconductor industry.

Gold surged to another record high, driven by safe-haven demand. Prices peaked at $3,357.40 per ounce before settling near $3,341.91. Meanwhile, the US dollar firmed slightly, though broader sentiment remained cautious. The dollar index ticked up to 99.562, and the euro dipped 0.3% to $1.1367.

Federal Reserve Chair Jerome Powell also weighed in on the economic landscape, cautioning that trade tensions could slow growth while contributing to inflation.

“Powell is between a rock and a hard place,” said Tom Graff of Facet.

Bond markets remained relatively calm, with the US 10-year Treasury yield inching up to 4.311%. Oil prices extended gains, with Brent crude futures climbing 0.93% to $66.46 a barrel on expectations of tighter global supply.

The Wall Street Journal and Reuters contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned