At QVC’s television studios, a host demonstrated a vegetable chopper to a smiling audience, the New York Times reports.

But behind the scenes, a changing retail landscape is presenting serious challenges for the shopping network once synonymous with impulse buys and spontaneous spending.

QVC, short for “Quality, Value and Convenience,” has weathered many storms since its launch in 1986. Yet today, it finds itself at the crossroads of multiple disruptions — from geopolitical trade tensions to digital upheaval and shifting consumer behavior.

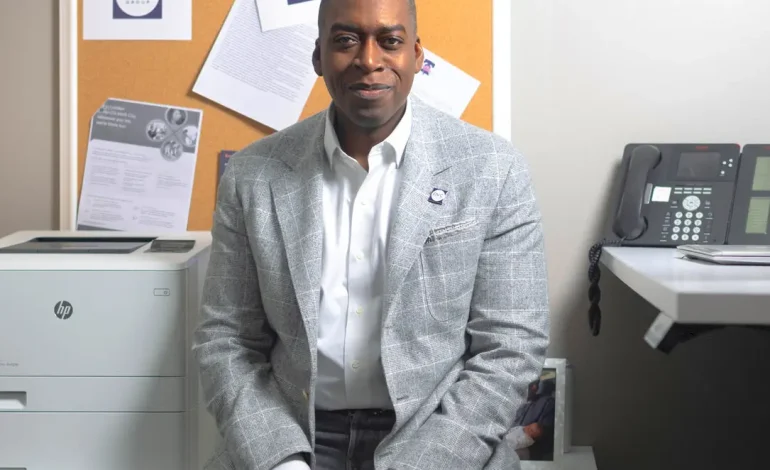

In a recent interview, QVC’s chief executive David Rawlinson II addressed the confluence of events reshaping the business. Among the most pressing is the dramatic expansion of tariffs on Chinese goods by President Trump, raising costs on imported items the company relies heavily upon. With tariffs exceeding 100% on some products, sourcing and pricing have become a daily balancing act.

“These days we can be disrupted every day,” Rawlinson said. “We may have to buy differently. We may have to source differently. We may have to price differently. But the fundamentals of what we do are not going to change.”

QVC’s challenges extend beyond trade. Cable viewership — once the company’s main conduit to customers — has dropped nearly 45% since 2018. Meanwhile, platforms like TikTok are rapidly drawing the attention of younger, tech-savvy shoppers who buy directly through apps.

To adapt, QVC became the first US brand to stream continuously on TikTok, aiming to meet customers where they are. But the platform itself is under scrutiny, and Rawlinson admits the strategy is based on present realities rather than long-term certainties.

“You have to deal with the world as it is today,” he said. “We don’t know what the world’s going to be tomorrow.”

Traditionally, QVC has thrived on the spontaneous — the thrill of an unexpected deal, the excitement of discovering something new during a broadcast. But consumer confidence has dipped amid economic volatility, and even QVC’s special offers, like a discounted water bottle duo, have struggled to spark interest.

Rawlinson noted that during heavy news cycles, viewership on QVC tends to drop.

“We are sort of inversely correlated to news consumption,” he explained.

Despite layoffs earlier this year and ongoing uncertainty, Rawlinson remains focused on agility and evolution. He says his leadership experience — shaped partly by his first CEO role at NielsenIQ during the pandemic — has taught him to act with more confidence and prioritize personal well-being to remain an effective leader.

Still, the road ahead is uncertain. Global supply chains are shifting. Social media is reshaping the shopping journey. And economic headwinds — from inflation to rising interest rates — continue to weigh on retailers and consumers alike.

Yet Rawlinson remains optimistic that QVC can endure.

“In 10 years, social shopping is going to be massive,” he predicted. “And we’re going to be playing in a very substantial way in that.”

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned