Swiss pharmaceutical company Roche has unveiled plans to invest $50 billion in the United States over the next five years, a move that will create more than 12,000 jobs and significantly expand its domestic manufacturing footprint.

The announcement comes amid broader industry efforts to respond to proposed changes in US trade policy, including potential new tariffs on imported pharmaceutical products.

The investment, one of the largest ever by a foreign pharmaceutical firm in the US, will support a wide range of initiatives, including the development of state-of-the-art research and manufacturing facilities. These will be located across several states, including California, Indiana, Massachusetts, New Jersey, and Pennsylvania.

CEO Thomas Schinecker described the move as a continuation of Roche’s long-standing presence in the US, where the company currently employs over 25,000 people across 24 sites.

“Our investments of $50 billion over the next five years will lay the foundation for our next era of innovation and growth, benefiting patients in the US and around the world,” Schinecker said.

The plan includes a new factory dedicated to the production of next-generation weight-loss treatments, as well as a site in Indiana focused on continuous glucose monitoring. Roche also announced a new AI-focused R&D hub in Massachusetts for research in cardiovascular, renal, and metabolic diseases.

Of the newly created jobs, approximately 6,500 will be in construction, while around 1,000 will be permanent roles at new and expanded facilities. The remaining positions will support the company’s broader US manufacturing efforts.

Roche’s investment follows similar announcements from other pharmaceutical companies, including Novartis, Eli Lilly, and Johnson & Johnson, all of which have expanded their US operations amid shifting trade dynamics. Novartis, also headquartered in Switzerland, recently committed $23 billion to bolster its American footprint.

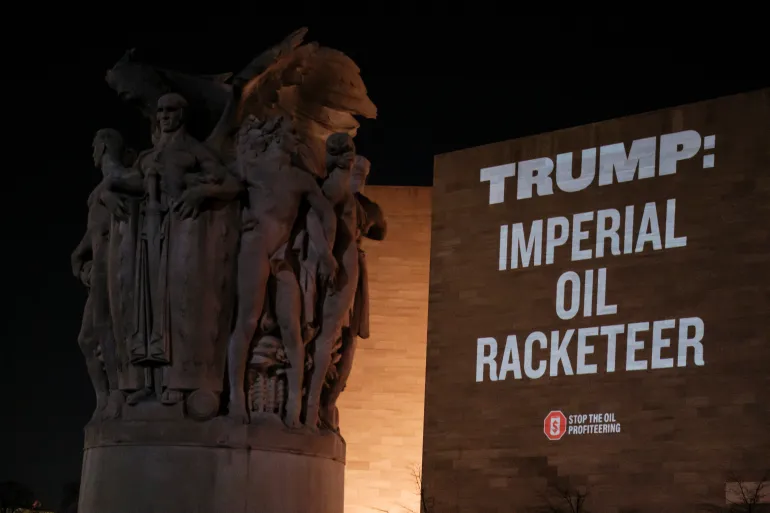

The pharmaceutical industry is preparing for possible changes to tariff exemptions. Earlier this month, President Donald Trump signaled that the US may impose new tariffs on imported medicines, a decision that could have significant implications for global drugmakers. In 2024, the US imported an estimated $213 billion worth of pharmaceuticals, up from $73 billion in 2014.

Although Roche’s announcement did not explicitly mention tariffs, the company has confirmed it is actively analyzing the impact of potential trade barriers. A spokesperson noted that Roche is “well prepared to navigate them, apply mitigation measures, and adapt.”

Importantly, once the new facilities are operational, Roche expects to export more pharmaceutical products from the US than it imports—an important shift that may help reduce the company’s exposure to international trade risks.

The investment also aligns with ongoing discussions between Swiss and US officials, particularly around the proposed 31% tariff on Swiss goods. Swiss President Karin Keller-Sutter is currently in Washington meeting with American policymakers, with trade and investment likely high on the agenda.

Despite the major focus on its US strategy, Roche has emphasized that it does not plan to scale back its global operations and will provide more details on its international investment plans in the coming weeks.

With input from Reuters, CNBC, the Wall Street Journal, and the Associated Press.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned