The Hong Kong Monetary Authority (HKMA) is aggressively defending its currency peg against the US dollar, launching a fresh wave of interventions in the foreign exchange market, as per Bloomberg.

Authorities spent HK$9.5 billion ($1.23 billion) late Monday, following a massive HK$46.6 billion outlay on Friday, as the Hong Kong dollar continues to test the upper limit of its trading band.

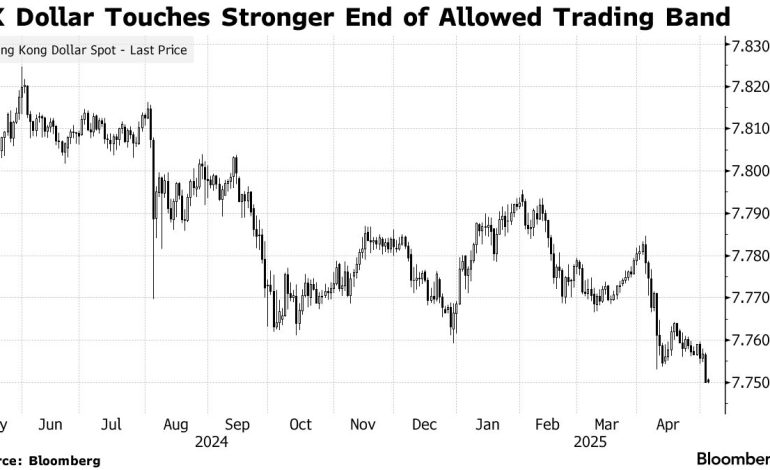

The repeated interventions are a direct response to the broader rally in Asian currencies, driven by a weakening US dollar and potential easing of US trade tariffs. This quarter alone, the Hong Kong dollar has appreciated by 0.4%, reaching the stronger end of its 7.75 to 7.85 per-dollar band on Monday.

The rapid appreciation of regional currencies, particularly those of trade-dependent economies, is causing concern among central bank policymakers. While a stronger currency can attract foreign investment and reduce import costs, it can also negatively impact exporters by making their goods less competitive in the global marketplace.

The HKMA’s actions highlight the delicate balancing act central banks face in managing currency fluctuations. The Hong Kong dollar’s peg to the US dollar is a cornerstone of its financial stability, requiring the HKMA to actively intervene in the market to maintain the fixed exchange rate.

The trend of central bank intervention isn’t limited to Hong Kong. Also on Monday, Taiwanese central bank officials announced their readiness to intervene in the foreign-exchange market if stability is threatened. This warning came after the Taiwan dollar experienced its largest surge in nearly four decades, underscoring the widespread pressure on Asian currencies.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned