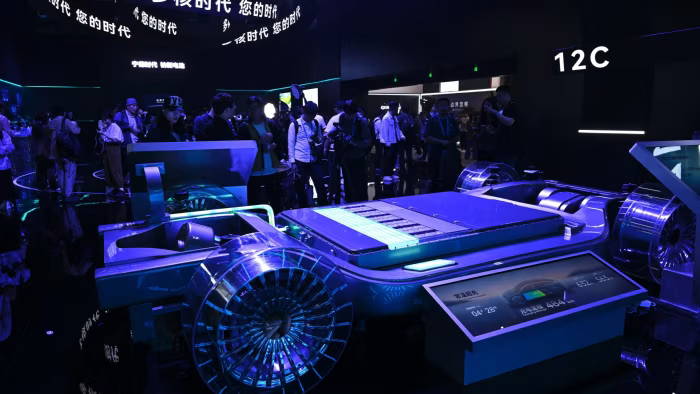

Chinese battery manufacturer Contemporary Amperex Technology Co. Ltd. (CATL) is set to raise up to US$4 billion through a secondary listing on the Hong Kong Stock Exchange, in what is poised to be the city’s largest initial public offering (IPO) of the year.

According to filings, CATL will offer 117.89 million shares at a maximum price of HK$263 (US$33.81) per share. The final price is expected to be confirmed by May 16, with trading scheduled to begin on May 20. The share sale includes an offer size adjustment option and a greenshoe option that could boost total proceeds to approximately US$5.3 billion.

CATL, already listed on Shenzhen’s ChiNext board, is the world’s largest maker of batteries for electric vehicles (EVs), accounting for over one-third of the global battery market in 2024. Its products were installed in more than 17 million EVs last year, representing one in every three vehicles globally. The company operates 13 manufacturing bases worldwide and has service outlets in 64 countries.

The listing comes amid a recovery in investor confidence, driven by signs of easing trade tensions between the US and China. Trade talks held in Geneva over the weekend were described by both sides as constructive, although significant tariffs remain in place. CATL acknowledged in its prospectus that while the long-term impact of such trade policies remains uncertain, the US market contributes only a small portion of its revenue.

Despite being placed on a US Defense Department list over alleged ties to China’s military, CATL said the designation has had no substantial effect on its business and is limited to dealings with certain US government entities. The company has focused on licensing its battery technology to American firms such as Ford and Tesla rather than establishing direct manufacturing operations in the US, a strategy shaped by US restrictions on Chinese battery imports.

A group of over 20 cornerstone investors, including state-owned oil giant Sinopec and the Kuwait Investment Authority, has committed to purchasing around US$2.62 billion worth of shares. Of the total offering, approximately 109.1 million shares will be allocated to institutional investors, with 8.8 million shares reserved for Hong Kong retail buyers.

The share price, if set at the HK$263 maximum, would represent a slight discount to CATL’s closing price in Shenzhen on Friday. CATL has received a waiver from the Hong Kong Stock Exchange allowing it not to disclose a minimum sale price, a move intended to prevent market disruption in its home listing.

Major banks including BofA Securities, Goldman Sachs, CICC, and JPMorgan are acting as joint sponsors and advisors for the Hong Kong offering.

If completed at the projected value, CATL’s IPO will surpass Midea Group’s US$4.6 billion Hong Kong offering last year.

With input from the Wall Street Journal, CNBC, and the Financial Times.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned