Blackstone Infrastructure has announced plans to acquire TXNM Energy in a transaction valued at $11.5 billion, including debt and preferred stock, as part of its ongoing expansion into the US utilities sector.

The all-cash deal, which is expected to close in the second half of 2026, marks a significant move by the asset management firm into the regulated electric utility space.

Under the terms of the agreement, Blackstone Infrastructure will pay $61.25 per share for TXNM Energy—representing a roughly 16% premium over TXNM’s closing share price of $52.88 on the preceding Friday. Shares of the Albuquerque-based utility company rose in response to the announcement, climbing over 7% in regular trading and as much as 9% in premarket activity.

TXNM Energy provides electricity to approximately 800,000 homes and businesses across New Mexico and Texas. The company is also expected to raise $400 million in equity prior to the closing of the deal. In the interim, Blackstone will invest $400 million by purchasing 8 million newly issued shares at $50 each to support TXNM’s capital and clean energy plans.

Blackstone Infrastructure—part of New York-based Blackstone Inc.—manages $60 billion in infrastructure assets and views the acquisition as a strategic play on rising energy demand and the long-term shift toward grid modernization and cleaner energy sources. The firm launched its stand-alone infrastructure strategy in 2017, which has become a growing component of its overall investment portfolio.

The acquisition follows a previously failed effort by Spanish energy firm Iberdrola’s US unit, Avangrid, to acquire TXNM (then known as PNM Resources) in a $4.3 billion deal. That transaction was ultimately terminated in 2023 after New Mexico regulators raised concerns about service reliability and customer complaints in other regions where Avangrid operates.

This time, both TXNM and Blackstone emphasized that the utility’s local management structure and headquarters in New Mexico and Texas would remain intact. Regulatory oversight of customer rates will continue to be handled by state authorities.

Blackstone intends to finance the purchase entirely with equity and has stated it does not plan to increase TXNM’s debt burden following the acquisition. The investment firm sees the company’s role in delivering stable, regulated utility services as aligned with its infrastructure portfolio’s long-term investment horizon.

TXNM CEO Pat Collawn will retire once the transaction closes. She will be succeeded by current company executive Don Tarry, maintaining continuity in leadership during the transition.

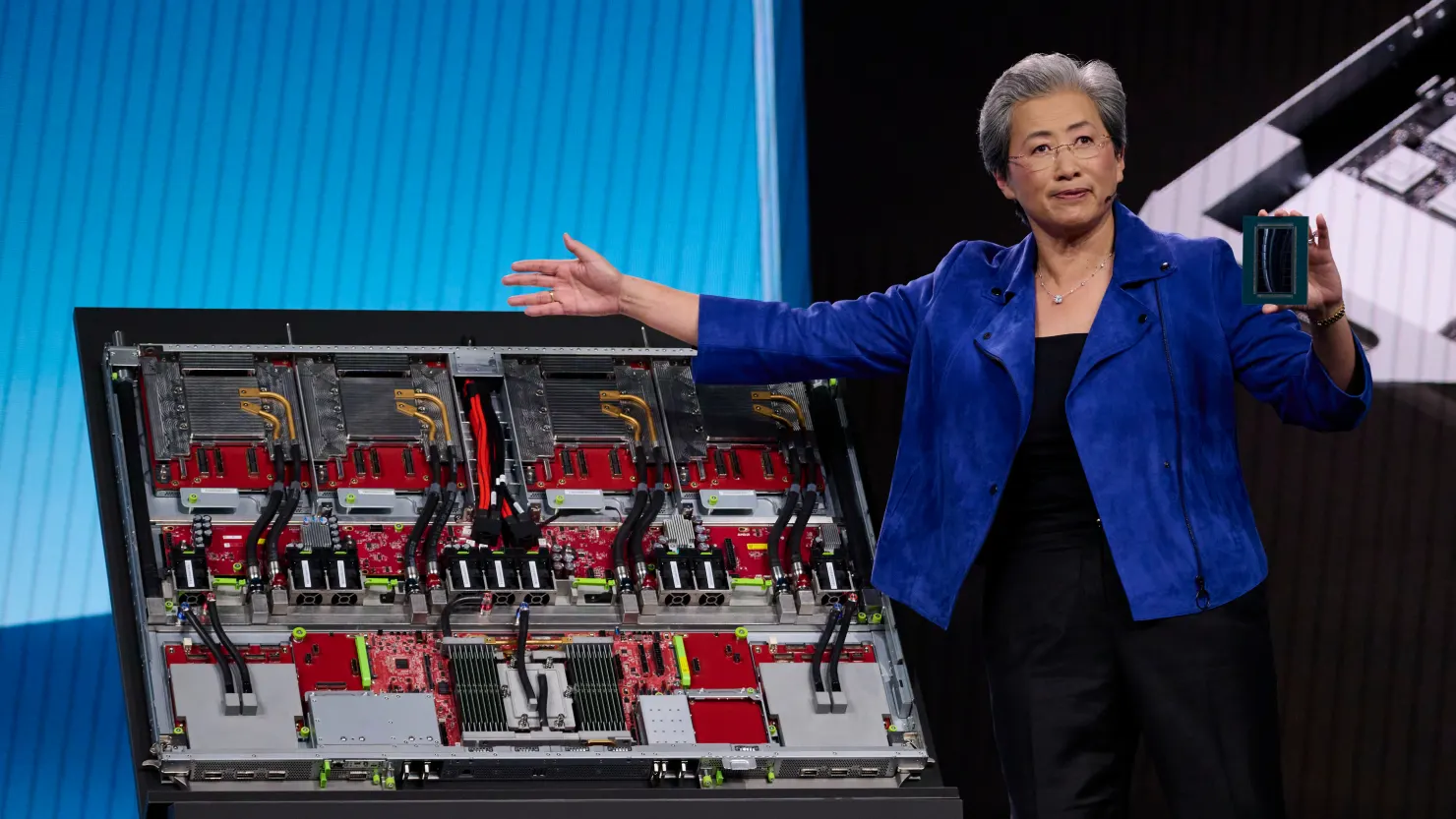

This acquisition comes amid a broader trend of investment activity in the US utilities sector, as companies respond to forecasted record-high power demand fueled by the growing energy needs of data centers, AI systems, cryptocurrency mining, and increasing residential and commercial consumption. Other recent transactions include NRG Energy’s $12 billion deal for power generation assets and a $2.8 billion stake purchase in American Electric Power’s transmission business by KKR and PSP Investments.

Reuters and the Wall Street Journal contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned