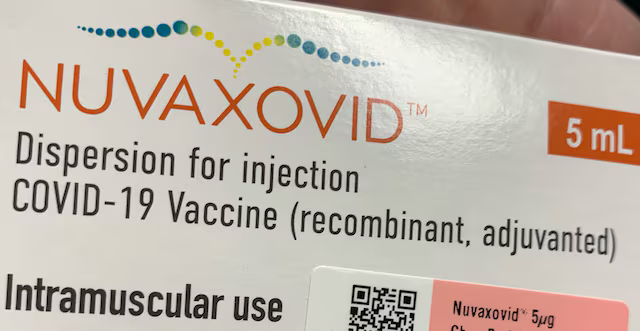

Novavax Inc. saw a sharp rise in its stock price on Monday after the US Food and Drug Administration (FDA) granted long-awaited full approval to its COVID-19 vaccine, Nuvaxovid.

The authorization, though limited in scope, marks a significant milestone for the Maryland-based biotechnology company.

Shares of Novavax surged more than 17% in premarket trading and climbed as much as 29% early in the day, following the FDA’s decision. The vaccine was approved for adults aged 65 and older, as well as individuals aged 12 to 64 who have underlying health conditions that increase their risk from COVID-19.

The regulatory clearance comes after months of uncertainty. The FDA missed an expected April 1 decision deadline, leading to speculation about the vaccine’s future. Additional scrutiny from US Health and Human Services Secretary Robert F. Kennedy Jr., who has publicly questioned the efficacy of protein-based vaccines like Nuvaxovid, added to investor anxiety. Kennedy has expressed skepticism about Novavax’s approach, arguing in a recent interview that targeting a single part of the virus has not traditionally proven effective for respiratory diseases.

Despite these challenges, analysts have generally responded positively to the FDA’s approval. BTIG analyst Thomas Shrader noted that while the label restrictions are unusual, they align with ongoing regulatory conversations. Similarly, Leerink Partners described the outcome as consistent with expectations and no more restrictive than anticipated based on guidance from the Centers for Disease Control and Prevention’s vaccine advisory committee.

Novavax’s vaccine, which uses a more traditional protein-based platform, has faced a tougher regulatory and commercial path compared to the mRNA-based shots developed by Moderna and Pfizer. Manufacturing setbacks and delays in approvals meant Novavax did not benefit from the early pandemic vaccine boom that buoyed its competitors.

Still, the FDA’s green light triggered a $175 million milestone payment to Novavax from French pharmaceutical company Sanofi, under the terms of a licensing deal struck earlier this year. Novavax and Sanofi plan to commercially distribute the shot in the US beginning this fall, pending an FDA recommendation on updated strains for the upcoming vaccination season.

Although the approval is limited, it represents a turning point for Novavax, which has seen its stock decline more than 16% year-to-date. The decision also has broader implications for the vaccine industry as it navigates regulatory expectations under new health leadership.

Further developments are expected soon. All COVID-19 vaccine makers, including Novavax, will need additional FDA approval to modify their vaccines to match emerging virus strains. The agency’s advisory panel is scheduled to meet later this week to consider those updates.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned