As interest rates remain a key concern for homebuyers across the United States, new data shows that Wyoming’s mortgage landscape closely mirrors national trends—offering some relative stability in an otherwise volatile market, Wyoming News Now reports.

According to a recent analysis by Construction Coverage using data from the 2024 Home Mortgage Disclosure Act, Wyoming’s median fixed mortgage interest rate stands at 6.750%, identical to the national median. This comes as the Federal Reserve’s anti-inflation measures continue to keep borrowing costs elevated, putting additional pressure on housing affordability.

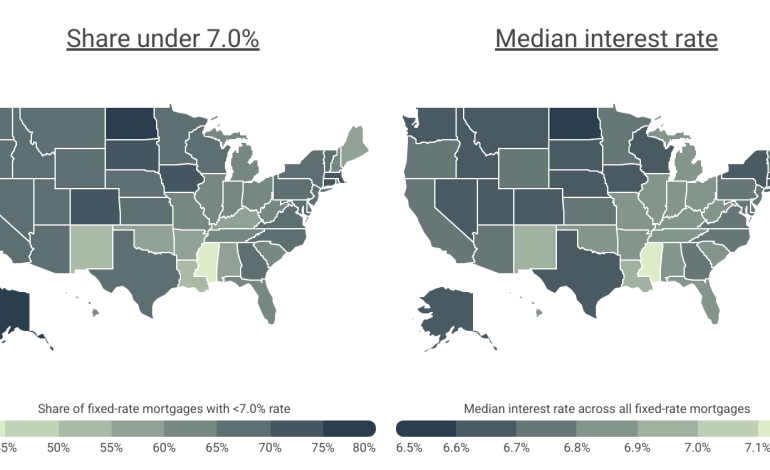

The study reveals that 66.4% of all fixed-rate mortgages approved in Wyoming in 2024 had rates under 7.0%, slightly above the national figure of 65.1%. When broken down by loan type, 67.6% of 30-year mortgages in the state came with rates below that threshold, compared to 65.1% nationally. For 15-year mortgages, Wyoming stands out more positively: 90.5% were approved with sub-7% rates, significantly higher than the US average of 82.9%.

While Wyoming’s borrowing environment appears relatively favorable compared to many Southern states, where fewer borrowers secure lower rates, it is not immune to the broader affordability challenges facing the housing market. The median home sale price in Wyoming for homes financed with a 30-year mortgage was $395,000, slightly below the national median of $415,000. For 15-year loans, the median sale price in Wyoming was $435,000, surpassing the national figure of $425,000.

Notably, Wyoming saw no year-over-year change in its median mortgage interest rate—a reflection of the national stabilization in rates after the dramatic increases of 2022 and 2023. That surge followed the Federal Reserve’s series of rate hikes aimed at reining in post-pandemic inflation, which had sent mortgage rates from historic lows near 2.65% in early 2021 to nearly 8% by late 2023.

Despite recent stabilization, mortgage affordability remains strained. The average monthly payment on a median-priced home has risen nearly 60% over the past three years, driven primarily by higher interest rates. While mortgage rates today are far below the highs of the early 1980s—when rates topped 18%—the pace of recent increases has been unprecedented, with 2022 alone seeing a 138% year-over-year jump in average rates.

Geographic variation in mortgage rates continues to be shaped by local economic conditions, lending practices, and borrower profiles. States such as Alaska and North Dakota lead the country in the share of homebuyers securing sub-7% rates, while some metro areas in Texas and the Deep South offer the least favorable terms. For its part, Wyoming sits close to the national average, suggesting a stable—if still costly—borrowing climate for prospective homeowners.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned