Nvidia, the leading semiconductor firm at the center of the artificial intelligence (AI) boom, is preparing to release its fiscal first-quarter earnings for 2025 — and the stakes couldn’t be higher, Quartz reports.

With analysts forecasting $43.26 billion in revenue, up nearly 66% from the same quarter last year, and a 44% rise in adjusted earnings per share to $0.88, Wall Street is watching closely to see whether Nvidia can maintain its status as the cornerstone of AI infrastructure or if growing pressures — both competitive and geopolitical — will temper its momentum.

Nvidia’s rapid ascent to a $3.3 trillion valuation has been powered largely by its Data Center division, now the company’s most profitable segment. Fueled by surging demand from cloud providers and AI developers, this segment is expected to deliver over $21 billion in quarterly revenue.

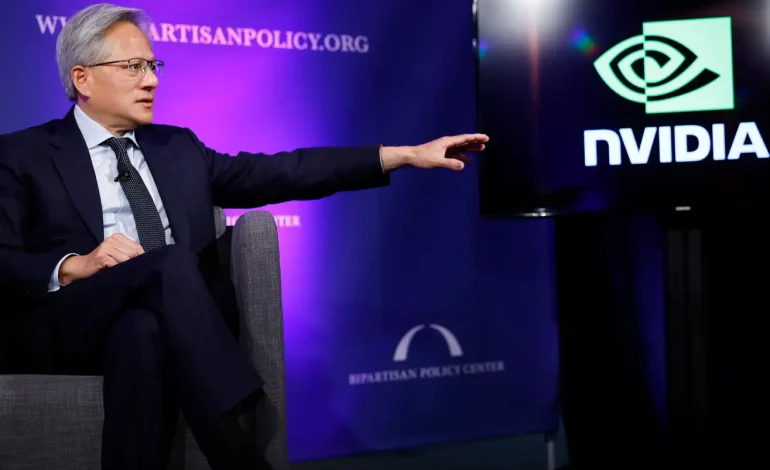

CEO Jensen Huang has strategically positioned Nvidia not just as a chipmaker, but as a critical enabler of the AI ecosystem. The company’s new Blackwell GPU architecture, introduced in March, promises significant performance gains and is already being adopted by hyperscalers such as Amazon Web Services, Google Cloud, Microsoft Azure, and Oracle.

While Nvidia’s hardware continues to set the pace for AI workloads, the company is expanding its role in the tech stack. From networking and software solutions to cloud integrations, Nvidia is diversifying its revenue base and aiming to reduce its reliance on hardware alone.

Investors will be looking for signs that these efforts are translating into real growth. In particular, revenue from networking products and AI software adoption across sectors like finance, healthcare, and manufacturing will be closely scrutinized. Any expansion in profit margins could also support Nvidia’s bid to become a high-margin platform company rather than just a cyclical chipmaker.

Despite its dominant market position, Nvidia is not immune to challenges. One of the largest uncertainties facing the company is its diminishing footprint in China, due to US export restrictions and intensifying competition from local Chinese chipmakers. Once commanding a near-total share of China’s AI chip market, Nvidia’s position has now reportedly fallen to around 50%.

In response, the company is exploring compliant chip models and a potential R&D center in Shanghai to retain some presence. Wall Street will be keen to assess how US-China tensions and ongoing export controls are affecting sales and growth opportunities.

Meanwhile, rivals such as AMD and Intel are racing to close the performance gap, while tech giants like Amazon and Google are investing in custom silicon to reduce dependency on third-party GPU suppliers.

Nvidia’s stock has been volatile in 2025 — climbing early in the year before experiencing turbulence amid broader tech market shifts. Political developments, such as President Trump’s April “Liberation Day” announcement, have also triggered short-term dips.

As Nvidia prepares to report earnings, investors are not just looking for a strong quarter. They want validation that the AI investment cycle is continuing — and that Nvidia remains at the heart of it. A beat on earnings and strong forward guidance could reassure markets that demand remains robust and that enterprise adoption of AI is broadening beyond experimental projects.

On the flip side, any shortfall — even a minor one — could signal a potential recalibration of expectations, especially given Nvidia’s lofty valuation.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned