Nvidia is preparing to launch a new artificial intelligence (AI) chip for the Chinese market that will be significantly less expensive than its previous model restricted by US export controls, according to multiple sources familiar with the matter, Reuters reports.

The new graphics processing unit (GPU), based on Nvidia’s latest Blackwell architecture, is expected to be priced between $6,500 and $8,000—a notable drop from the $10,000–$12,000 range of the earlier H20 model, which is now subject to US export restrictions. Mass production could begin as early as June, sources told Reuters.

The lower price point reflects reduced performance specifications and a simplified manufacturing process. The GPU will reportedly use conventional GDDR7 memory rather than high-bandwidth memory (HBM) and will not rely on advanced packaging technology such as Taiwan Semiconductor Manufacturing Co.’s (TSMC) Chip-on-Wafer-on-Substrate (CoWoS). TSMC declined to comment.

The chip will reportedly be based on the RTX Pro 6000D, a server-class processor that meets new US regulatory limits on GPU memory bandwidth—capped at approximately 1.7–1.8 terabytes per second. That compares to the H20’s 4 terabytes per second, which exceeded the current export thresholds.

A spokesperson for Nvidia stated that the company is still evaluating its limited options.

“Until we settle on a new product design and receive approval from the US government, we are effectively foreclosed from China’s $50 billion data center market,” the spokesperson said.

China remains a significant market for Nvidia, accounting for 13% of its global revenue in the last fiscal year. This marks the third instance in which Nvidia has had to develop a China-specific chip after export curbs aimed at limiting China’s access to advanced AI capabilities.

Despite reduced performance, the upcoming Blackwell-based chip is seen as an attempt to maintain a presence in the world’s second-largest economy, where Huawei has emerged as a key competitor with its Ascend 910B chip. Analysts expect Chinese technology firms to narrow the performance gap with Nvidia within the next one to two years.

“Nvidia’s remaining edge lies primarily in its ability to integrate AI clusters with its CUDA platform,” said Nori Chiou, investment director at White Oak Capital Partners.

CUDA is Nvidia’s proprietary platform for building AI models and applications and has become deeply entrenched in the AI development ecosystem.

In addition to the June launch, sources say another Blackwell-architecture GPU specifically designed for China may begin production in September, although details about that chip remain undisclosed.

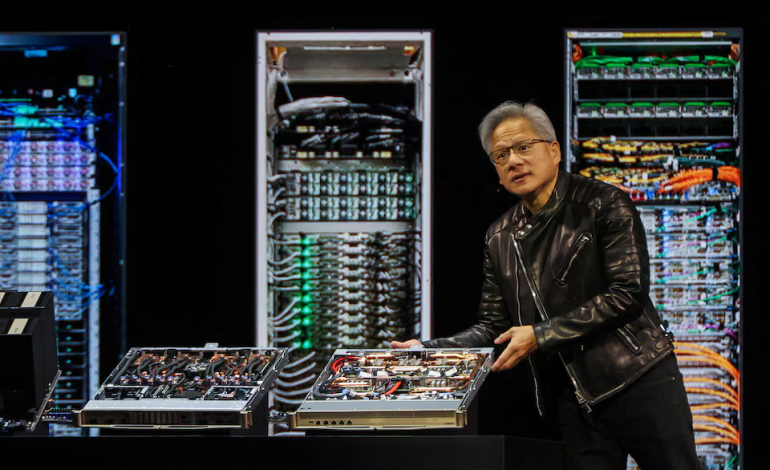

The US government’s latest export rules, enacted in April, rendered the H20 ineligible for sale in China. Nvidia subsequently abandoned efforts to modify that chip to meet the new requirements. CEO Jensen Huang confirmed last week that Nvidia’s market share in China has dropped from 95% in 2022 to around 50%.

The restrictions have had a tangible financial impact: Nvidia wrote off $5.5 billion in inventory and missed out on an estimated $15 billion in potential sales, according to Huang.

Chinese brokerage GF Securities has speculated that the new GPU may be named either the 6000D or B40, though no official name or pricing has been confirmed by Nvidia.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned