Apollo Global Management has announced it will suspend recruiting for its 2027 associate class, breaking with a long-standing private equity industry practice that has drawn increasing criticism from major Wall Street banks.

The move, communicated in a letter to candidates on Wednesday, reflects growing concerns over the accelerated timeline in which junior investment bankers are recruited for roles that begin years later. Apollo, which manages $785 billion in assets, is one of the most prominent firms to step back from so-called “on-cycle” recruiting—an informal, fast-paced hiring process that pressures first-year bankers to secure private equity jobs shortly after beginning their careers.

“We believe you should take time early in your career to deepen your understanding of the business world and reflect on what you are most passionate about,” the letter from Apollo’s Co-Head of Private Equity David Sambur and Head of Human Capital Nicole Bonsignore stated. “With that in mind, we will not formally interview and extend offers this year for the Class of 2027.”

The decision comes amid broader tensions between investment banks and private equity firms over how young talent is hired and retained. JPMorgan Chase recently took a firm stance against early recruiting, warning its incoming analysts that accepting future-dated private equity roles before or shortly after starting at the bank could result in termination. CEO Jamie Dimon has publicly called the practice “unethical,” citing potential conflicts of interest and rushed decision-making by new graduates.

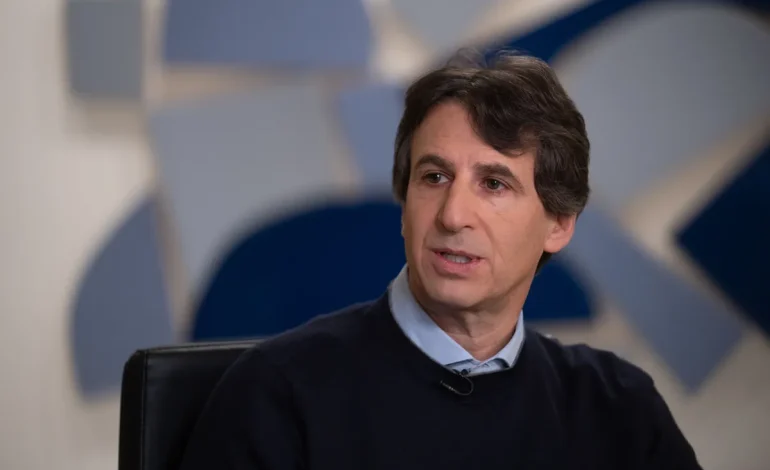

Apollo CEO Marc Rowan echoed these concerns.

“When someone says something that is just plainly true, I feel compelled to agree with it,” Rowan said in a statement. “Recruiting has crept earlier and earlier every year, and asking students to make career decisions before they truly understand their options doesn’t serve them or our industry.”

Apollo’s announcement is expected to reshape the timeline for junior private equity recruiting, a process that in recent years has seen firms compete to lock in talent just weeks after candidates graduate and before they begin training at investment banks. Critics argue this leaves little room for informed career choices and often leads to high turnover rates.

“Great candidates making rushed decisions creates avoidable turnover—and that serves no one,” Rowan added.

With input from Bloomberg, Business Insider, and the Financial Times.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned