US President Donald Trump has often emphasized business investment as a cornerstone of his economic policy, recently stating that more than $12 trillion has been “practically committed” during his administration, BBC reports.

He credits this surge to a mix of tariffs, tax cuts, and deregulation, calling the figure unprecedented.

If accurate, the claim would imply a dramatic acceleration in economic activity—roughly triple the $4 trillion in gross private investment the US reported last year. But a closer look reveals a more complex and uncertain picture.

Investment statistics in the US are released quarterly, and it’s still early in Trump’s second term. Data from January through March—covering just two months of his current presidency—shows a strong rise in investment. However, analysts caution that this may be influenced by temporary factors, such as the resolution of a previous Boeing strike.

“There’s hardly any fresh data yet, and much of what we see now likely reflects plans made last year,” said Nick Bloom, an economics professor at Stanford University. “My guess is business investment is actually down slightly due to elevated uncertainty.”

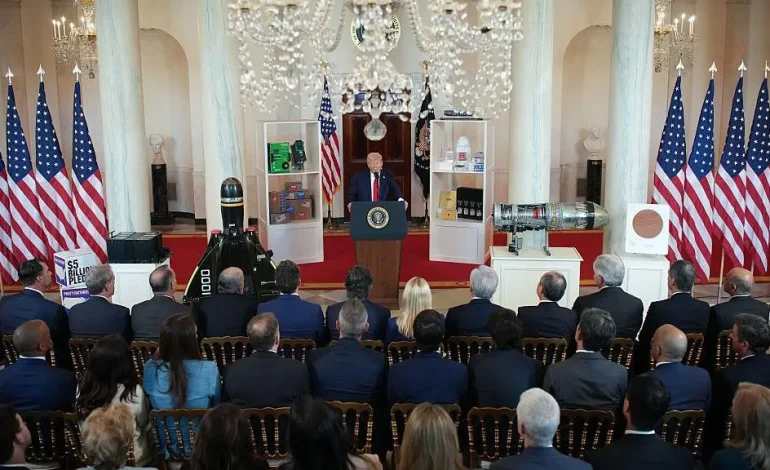

The Trump administration has highlighted commitments from firms like Apple, Hyundai, and Roche Pharmaceuticals as evidence of success. The White House keeps a list of such pledges, estimating their combined value at $5.3 trillion as of early June—still less than half the $12 trillion cited by the president.

Yet many of these announcements include investments that began before Trump took office or are not traditional business investments at all. For example:

Corning’s $1.5 billion manufacturing project includes $900 million announced in early 2024.

Stellantis’ $5 billion investment in reopening a factory was first pledged in 2023.

Apple’s $500 billion figure includes taxes and employee salaries, not just new capital spending.

Some pledges involve international investments or rely on foreign government backing.

Goldman Sachs analysts estimate that new investment directly linked to these announcements is closer to $134 billion, potentially falling to $30 billion once likely outcomes and preexisting plans are accounted for.

Analysts note that companies may have incentives to overstate investment plans, especially in an environment where public praise from the White House could yield favorable treatment.

“Announcing a large investment can be a strategic move,” said Martin Chorzempa, senior fellow at the Peterson Institute for International Economics. “It creates goodwill without necessarily committing the company to actual follow-through if conditions change.”

That said, Trump’s policies have had some measurable effects. In the pharmaceutical sector, for example, tariff threats have encouraged firms to consider more US-based manufacturing. However, many of these projects are long-term, often taking a decade or more to unfold. And they typically involve branded drugs, not generics, which are still predominantly made overseas.

While Trump’s goal of boosting domestic investment is widely supported, experts question the effectiveness of the tools being used.

Economist Germán Gutiérrez of the University of Washington argues that factors like industry consolidation—rather than foreign competition—have played a larger role in suppressing investment.

“Once industries are dominated by a few large players, the incentive to invest to stay competitive declines,” he explained.

Furthermore, investment today often skews toward less capital-intensive areas such as software, rather than factories or equipment—limiting the potential for dramatic headline growth.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned