Nvidia, now trading at all-time highs, has reclaimed its position as the world’s most valuable publicly traded company, Business Insider reports.

With a current market capitalization of approximately $3.77 trillion following Wednesday’s record close at $154.31 per share, some analysts believe the company’s growth potential is far from exhausted.

One of the most bullish forecasts comes from Loop Capital analyst Ananda Baruah, who recently raised his price target for Nvidia to $250 per share — the highest on Wall Street. This target implies a potential upside of more than 120% and a future market value of roughly $6 trillion.

Baruah’s outlook is grounded in expectations for a substantial increase in spending on artificial intelligence infrastructure, particularly from cloud service providers and hyperscalers such as Amazon and Microsoft. Loop Capital projects that spending on non-CPU compute technologies — including GPUs and other AI accelerators — could rise significantly over the next several years, potentially growing from 15% of infrastructure budgets to between 50% and 60% by 2028.

That shift could translate into roughly $2 trillion in AI-specific capital expenditure by 2028, according to Loop Capital estimates. Much of this would benefit Nvidia, which supplies critical components for training and deploying AI systems.

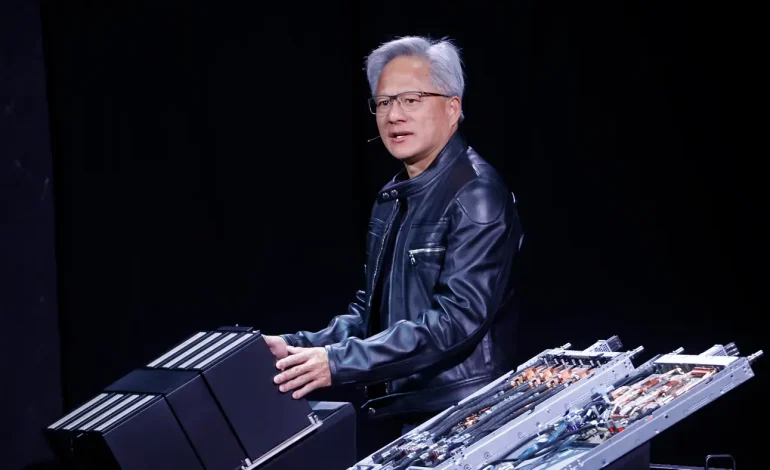

Central to this thesis is the rising demand for AI “factories” — vertically integrated data centers designed for intensive AI workloads. Nvidia CEO Jensen Huang has previously noted that each gigawatt of AI factory demand could generate $40 to $50 billion in Nvidia revenue. Analysts say tens of gigawatts could be required within the next two to three years.

Loop Capital also points out that newer AI models are becoming far more compute-intensive, with some next-generation reasoning models requiring up to 150 times the computational power of earlier large language models. This rising complexity is prompting tech companies to invest more heavily in Nvidia’s high-performance hardware.

Baruah projects Nvidia’s data center revenue could rise from $115 billion in fiscal year 2025 to $367 billion by 2028. The firm argues that Nvidia’s dominant position in the AI accelerator space — described as “essentially a monopoly for critical tech” — gives the company pricing leverage and the potential for expanding profit margins.

“We’re entering the next ‘Golden Wave’ of generative AI adoption,” Baruah wrote, emphasizing Nvidia’s central role in this growth phase.

Despite earlier market turbulence in 2025 — including concerns over tariffs and competition from Chinese firms like DeepSeek AI — Nvidia has rebounded strongly, with its stock rising around 1% again on Thursday.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned