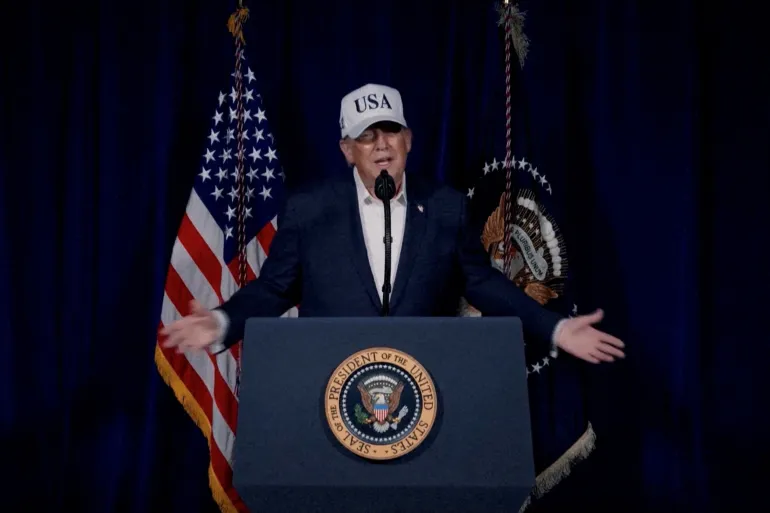

Global Markets Mostly Decline Ahead of Trump’s Tariff Deadline, While US Stocks Hit New Highs

Global stock markets largely declined on Friday as investors grew cautious ahead of the July 9 tariff deadline set by US President Donald Trump, the Associated Press reports.

While uncertainty weighed on shares across Europe and Asia, US equities continued to push into record territory following a stronger-than-expected jobs report.

In Europe, early trading saw key indexes move lower. Germany’s DAX slipped 0.8% to 23,730.61, France’s CAC 40 dropped 1.1% to 7,666.91, and Britain’s FTSE 100 fell 0.4% to 8,790.21. US futures also showed weakness, with contracts tied to the S&P 500 and Dow Jones Industrial Average both down 0.5%.

Asian markets experienced a mixed session. Japan’s Nikkei 225 managed to reverse early losses to close 0.1% higher at 39,810.88. In contrast, South Korea’s KOSPI declined sharply, dropping 2% to 3,054.28. Hong Kong’s Hang Seng index fell 0.6% to 23,916.06, while China’s Shanghai Composite edged up 0.3% to 3,472.32. Australia’s S&P/ASX 200 added 0.1%, and India’s Sensex index slipped 0.1% to 83,148.45.

Market sentiment in Asia reflected caution rather than confidence, according to Stephen Innes, managing partner at SPI Asset Management.

“Asian markets slipped into Friday like someone entering a dark alley with one eye over their shoulder,” he said, referring to concerns about the looming tariff deadline.

Innes noted that while US equities climbed higher on strong labor data, Asian investors remained wary of possible trade disruptions.

Trump’s proposed tariffs on various imports are currently on hold but are scheduled to take effect next week unless new trade agreements are reached. Mizuho Bank reported that some countries may begin receiving official notices regarding tariff levels as early as Friday, raising the possibility of renewed market volatility.

On Wall Street, stocks continued their upward trajectory on Thursday. The S&P 500 climbed 0.8% to reach an all-time high for the fourth time in five days. The Dow Jones Industrial Average rose 344 points, or 0.8%, and the Nasdaq Composite gained 1%.

In commodities, US benchmark crude fell 45 cents to $66.55 per barrel, while international benchmark Brent crude dropped 53 cents to $68.27 per barrel.

In currency markets, the US dollar weakened slightly, falling to 144.34 Japanese yen from 144.92 yen. The euro gained marginally, rising to $1.1773 from $1.1761.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned