The US dollar remained close to multi-year lows on Monday as investors awaited developments ahead of President Donald Trump’s upcoming tariff deadline, Reuters reports.

Currency markets were largely cautious as the 90-day moratorium on the administration’s “Liberation Day” reciprocal tariffs is set to expire Wednesday, with higher duties scheduled to take effect from August 1.

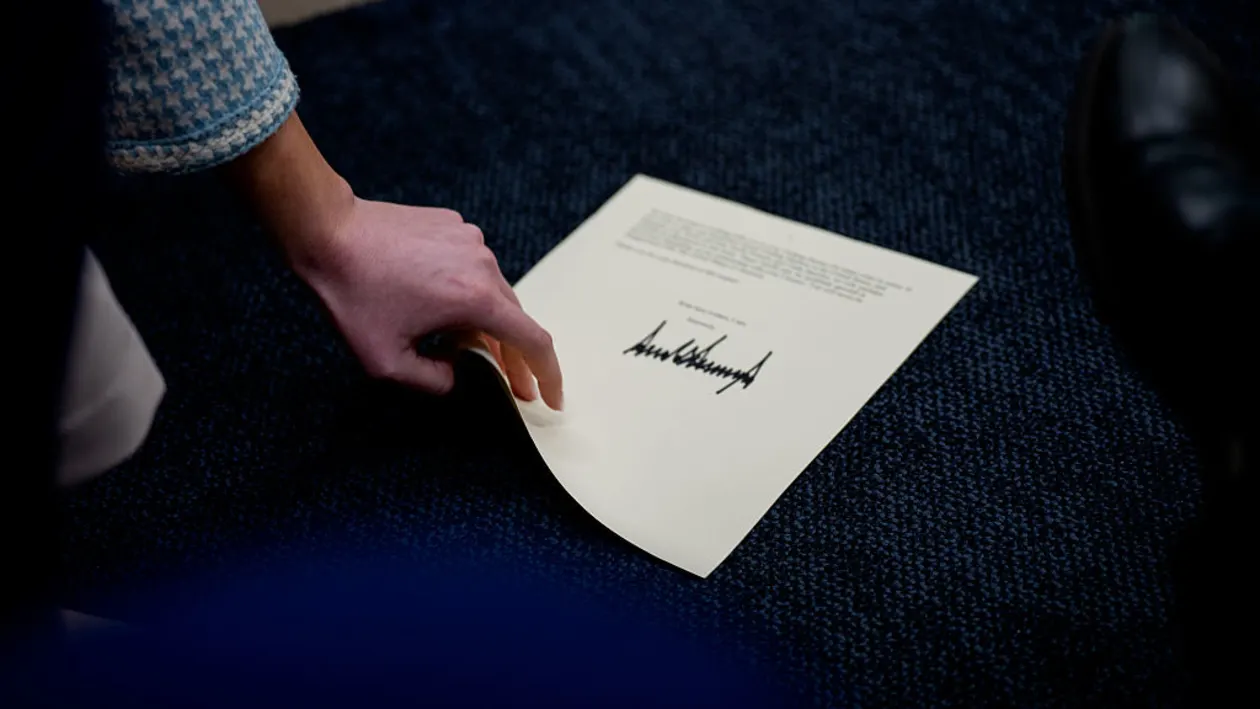

President Trump stated over the weekend that his administration is finalizing several trade agreements, though he also indicated that a number of countries would soon receive formal notice of increased tariffs. He added that nations perceived as aligning with the BRICS bloc’s “anti-American” policies could face an additional 10% levy.

Thus far, only Britain, China, and Vietnam have reached any form of trade understanding with the United States under the new policy framework.

The uncertainty surrounding the potential scope and impact of the tariffs has contributed to weakness in risk-sensitive currencies, including the Australian and New Zealand dollars. Both currencies declined on Monday ahead of key interest rate decisions in their respective countries. The Australian dollar fell 0.7% to $0.6507, while the New Zealand dollar lost 0.7% to $0.6008.

Markets expect the Reserve Bank of Australia (RBA) to lower its benchmark interest rate by 25 basis points on Tuesday, citing slower inflation and modest economic growth. Analysts anticipate dovish forward guidance, with the potential for additional cuts later in the year. The Reserve Bank of New Zealand, in contrast, is widely expected to keep rates unchanged this week, though a further cut is forecast by some economists before year-end.

In broader currency markets, the euro declined 0.3% to $1.1750, and the British pound edged down to $1.36, remaining near a recent high reached on July 1. The US dollar traded at 0.7959 Swiss franc, close to a low not seen since January 2015, and strengthened 0.38% to 145.15 yen, reversing earlier losses.

The US dollar index, which measures the greenback against six major currencies, rose 0.26% to 97.223. However, it remains near last week’s 3.5-year low of 96.373. The index has fallen significantly in 2025 as investors reassess the dollar’s traditional safe-haven role amid shifting trade dynamics and broader global economic uncertainty.

Despite multiple rounds of negotiations, the United States has made limited progress on trade deals with key partners such as Japan and the European Union, raising concerns about the potential economic fallout if no agreements are reached before the new tariffs take effect.

Currency strategists suggest that while volatility is expected around the tariff deadline, market reactions may be more muted than in previous episodes.

“The current proposals are largely anticipated,” said James Kniveton, senior corporate FX dealer at Convera. “Markets appear to be pricing in the potential for further deadline extensions.”

Options market data also indicate limited expectations for sharp currency swings, reflecting some confidence that the most severe trade disruptions may yet be avoided.

The dollar also rose approximately 0.4% against both the Canadian dollar and the Mexican peso, trading at C$1.366 and 18.67 pesos, respectively.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned