The US dollar, long regarded as a symbol of American financial dominance, is experiencing its sharpest decline in decades — and prompting growing concern among global investors and economists about what that might mean for the future of US economic leadership, NPR reports.

In a rare market convergence, stocks, bonds, and the dollar are all falling at once. The dollar has dropped more than 10% in the first half of 2025, marking its worst start to a year since 1973, when the US severed the dollar’s link to gold.

This downturn is puzzling to some, particularly given that the US economy remains relatively strong. Yet the political and policy landscape — including rising tariffs, increasing federal debt, and interventions in central bank independence — has created uncertainty that’s rippling through global markets.

“America was already great,” said Kaspar Hense, senior portfolio manager at RBC BlueBay Asset Management. “We are coming from a very strong dollar level where US exceptionalism was what everybody was speaking about in financial markets.”

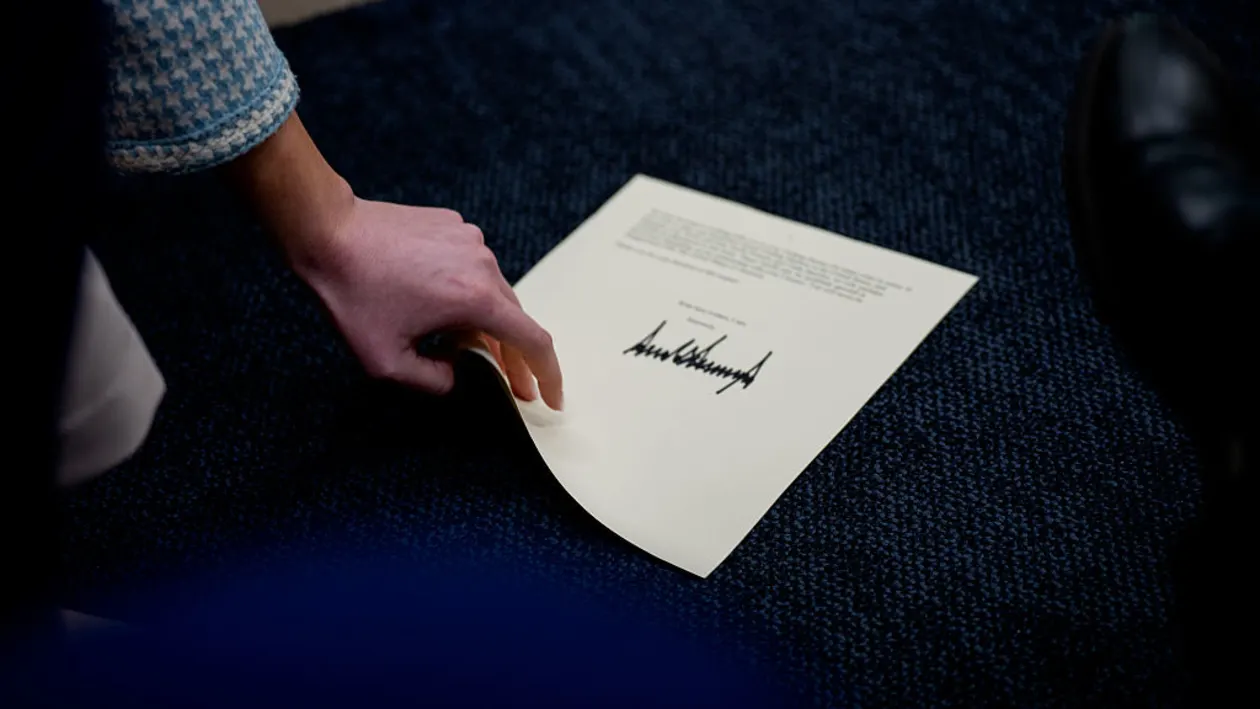

Much of the dollar’s decline is tied to a shift in global sentiment. President Donald Trump’s aggressive trade and fiscal policies — including sweeping tariffs, public criticism of the Federal Reserve, and the signing of the “One Big Beautiful Bill Act,” a large spending and tax measure — have raised questions about the long-term trajectory of US fiscal health.

Coupled with the ballooning national debt, these factors are making some investors reconsider whether the US dollar remains a stable, long-term store of value.

“How much do investors want to be overweight in dollars when they can sort of see this slow-motion train wreck coming?” asked Kenneth Rogoff, Harvard professor and former IMF chief economist.

As foreign investors sell off US stocks and bonds, they are effectively selling dollars, pushing the currency down further. A recent Bank of America survey showed that only 23% of global fund managers now prefer US equities, a stark shift after years of American market outperformance.

While the S&P 500 has risen more than 6% in 2025, it lags behind international markets like Germany’s DAX and Hong Kong’s Hang Seng, both up nearly 20% this year.

Not all analysts see the dollar’s weakness as a red flag. Some view it as a natural correction following years of strong US market performance and an unusually strong dollar.

“There’s a temptation for a lot of people to think of the strength of your currency as some sort of national virility symbol. It really isn’t,” said Kit Juckes, Chief FX Strategist at Societe Generale.

A weaker dollar has upsides for American exporters by making US goods more competitive abroad. It also boosts sectors like manufacturing and agriculture, which tend to struggle when the dollar is strong. And while it may raise travel costs for Americans abroad, it can benefit domestic tourism and companies with international revenue streams.

While the dollar remains the world’s dominant reserve currency, its position may not be permanent. Rogoff and others suggest the global monetary system could become more “tri-polar” in the coming decades, with the euro, Chinese yuan, and even cryptocurrencies gaining prominence.

“The dollar franchise isn’t gone, but it’s weakening materially,” Rogoff said. “The process is accelerating under Trump.”

He adds that while the dollar’s reserve currency status has shown resilience for decades, persistent debt, political instability, and global shifts in sentiment could lead countries and investors to seek alternatives.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned