Japan’s real wages fell at the fastest pace in nearly two years in May, highlighting persistent economic headwinds as inflation continues to outpace income growth, Reuters reports.

The data raises fresh concerns about the sustainability of consumption-led growth in the world’s fourth-largest economy.

According to figures released Monday by Japan’s Ministry of Health, Labour and Welfare, inflation-adjusted real wages dropped 2.9% year-on-year in May. This marks the steepest decline since September 2022 and the fifth consecutive monthly fall. The drop follows a revised 2.0% fall in April, underscoring a continuing gap between rising prices and earnings.

The ministry’s data uses a consumer inflation measure that includes fresh food but excludes rent, which showed a 4.0% annual increase in May. In contrast, nominal wages—or average cash earnings before inflation—rose just 1.0%, a slowdown from the 2.0% increase seen in April. This was the weakest nominal wage growth since March 2024.

One major factor behind the deceleration in nominal wages was an 18.7% decline in special payments, primarily one-off bonuses. Regular wages, or base pay, rose by 2.0%, and overtime pay increased by 1.0%, both slower than in the previous month.

While spring labor negotiations resulted in the largest average pay hikes for unionized workers in 34 years, those gains have not yet translated broadly across the economy. A labor ministry official noted that many respondents in the wage survey are small businesses that typically do not have unions and are slower to implement pay raises compared to larger firms.

Despite wage stagnation, household spending rose at its fastest pace in nearly three years in May, suggesting some resilience in consumer activity. Whether this trend can be sustained will likely depend on future wage developments.

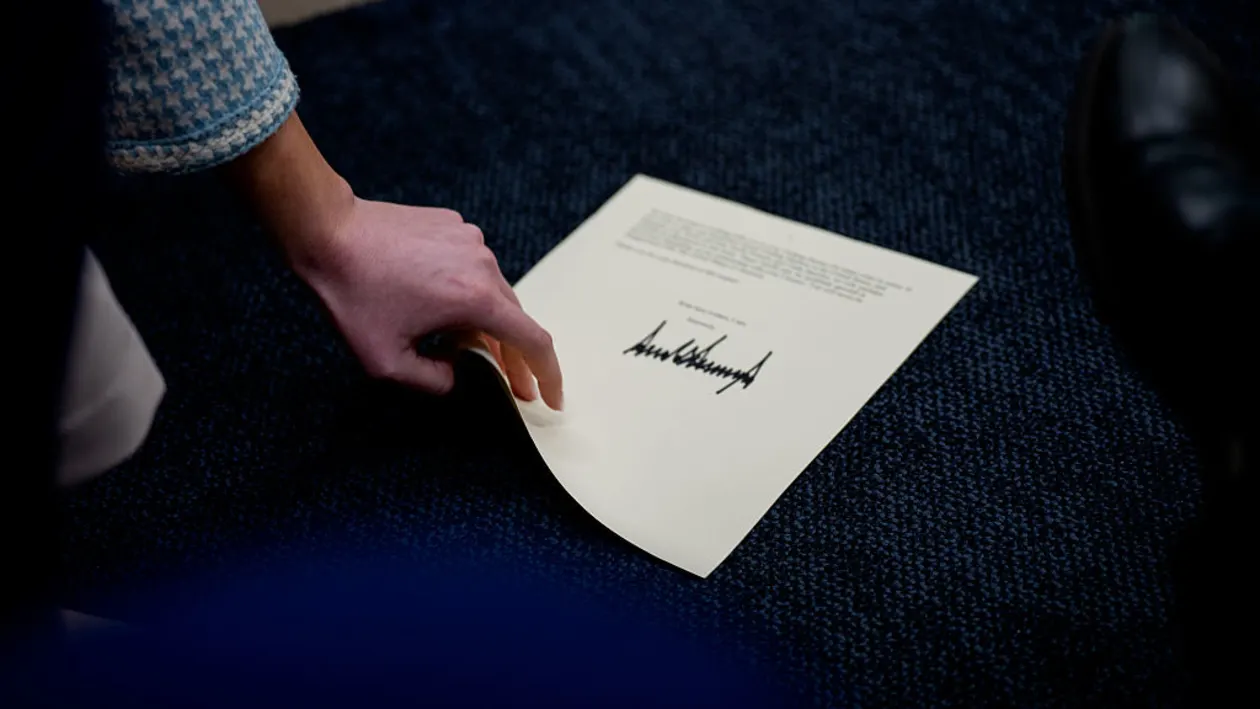

Wage growth is also a key indicator the Bank of Japan (BOJ) monitors closely in setting monetary policy. The central bank is weighing the potential timing of its next interest rate increase, but uncertainty around external factors—including potential US trade tariffs on Japanese exports—poses risks to corporate profits and future pay raises.

$1 = 144.25 yen

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned