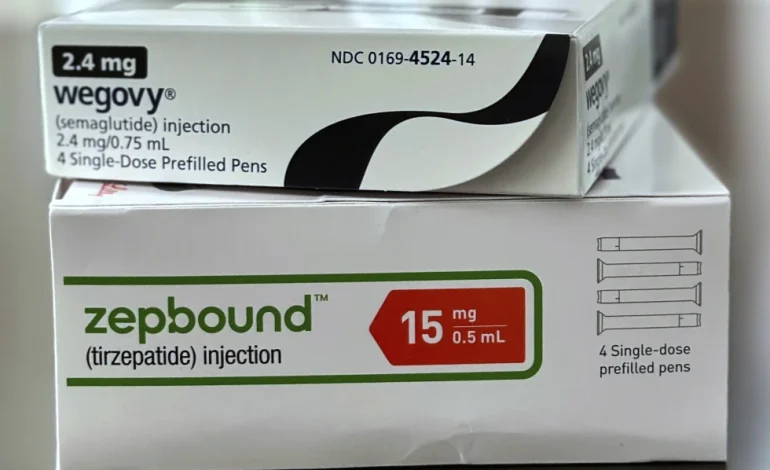

Prices are falling for popular obesity medications like Wegovy and Zepbound, yet widespread and reliable access to these treatments remains a significant challenge for many patients, the Associated Press reports.

While some price reductions have occurred—bringing the out-of-pocket cost to around $500 per month for uninsured individuals—the high cost still puts the drugs out of reach for many. Even among insured patients, coverage can be uneven, partial, or entirely absent.

“The medications should be available, the question is at what price and can people sustain that,” said Matt Maciejewski, a Duke University professor who studies obesity treatment coverage.

Wegovy and Zepbound, part of a class of medications called GLP-1 receptor agonists, have seen soaring demand. In the first quarter of 2025 alone:

Zepbound, produced by Eli Lilly, generated $2.3 billion in US sales.

Wegovy, from Novo Nordisk, logged nearly $1.9 billion in US sales and averages around 200,000 prescriptions per week.

Employer-provided insurance plans are increasingly including coverage for these drugs. According to benefits consultant Mercer, more large employers (500+ workers) are opting in.

Novo Nordisk reports that 85% of covered patients pay $25 or less monthly. However, government-funded programs like Medicare and most Medicaid plans still do not cover the medications when used solely for obesity.

Even where coverage exists, out-of-pocket expenses can still reach several hundred dollars per month. Drugmakers offer savings programs, but these are often limited in scope and duration.

“Coverage is not the same as access,” noted Dr. Beverly Tchang, a New York-based obesity specialist and advisor to both Novo Nordisk and Eli Lilly.

Some major pharmacy benefit managers (PBMs) have started making coverage decisions based on price negotiations. For example, the PBM affiliated with CVS Health recently dropped Zepbound from its national formulary in favor of Wegovy.

These changes can force doctors to revise treatment plans. Tchang said many of her patients who tolerated Zepbound better due to fewer side effects had to switch therapies.

Meanwhile, providers like Dr. Courtney Younglove in Kansas try to prepare patients in advance by asking them to check insurance coverage before scheduling visits. Still, some cancel appointments altogether once they learn of the potential cost.

During earlier shortages, compounding pharmacies and telehealth companies began selling lower-cost, custom-mixed versions of the medications. The FDA has declared the shortage over, but some compounding remains legal when personalized to patients.

Companies like Hims & Hers Health offer compounded versions of semaglutide, the active ingredient in Wegovy, starting at $165 per month, paid upfront.

Drugmakers have pushed back. Eli Lilly has filed lawsuits, and Novo Nordisk ended a short-lived partnership with Hims, citing safety concerns about compounded versions sourced from foreign suppliers. Hims maintains that its ingredients meet US safety standards and are verified by third-party labs.

Although current out-of-pocket prices have dropped from earlier highs, they still represent a large portion of many Americans’ income. A $500 monthly cost equates to roughly 14% of the average US annual income per person.

Future developments could help reduce costs further:

Both drugmakers are working on oral (pill) versions of their injectable treatments, which could reach the market within a year.

International pharmacies in countries like Canada are already offering lower prices, with some US patients saving as much as 15% by ordering abroad.

“I think price wars are going to drive it down,” said Younglove. “I think we are in the early stages. I have hope.”

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned