US markets opened lower on Monday, kicking off a closely watched week as investors await updates on the Trump administration’s global trade strategy.

While stocks have recently climbed to record highs, looming tariff announcements are testing investor confidence.

The Dow Jones Industrial Average was down 82 points, or 0.18%, at the open. The S&P 500 fell 0.34%, and the Nasdaq Composite dropped 0.5%. The modest declines come as Wall Street monitors a fast-approaching July 9 deadline for trade deals — the end of a 90-day tariff pause first announced in April.

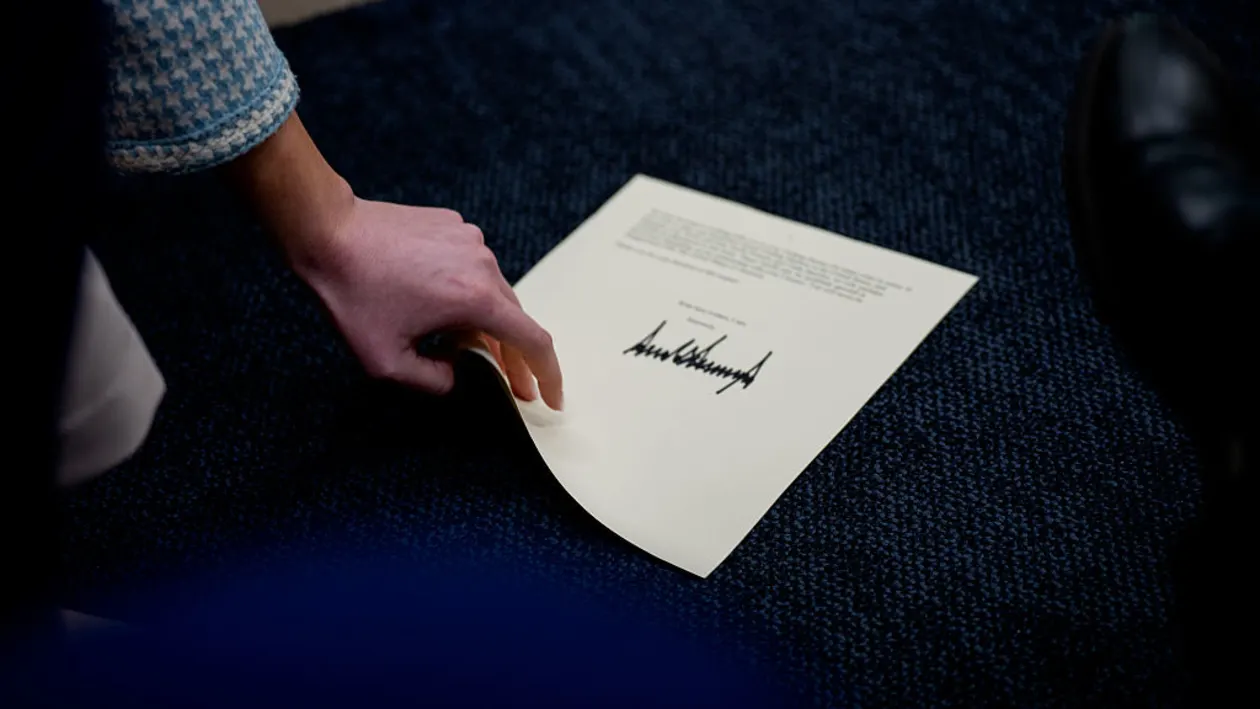

On Sunday, President Donald Trump said the US would begin sending “tariff letters” to multiple countries outlining potential new rates. If no agreements are reached, the updated tariffs would begin August 1, though Treasury Secretary Scott Bessent emphasized that negotiations may continue beyond that date.

“The letters are meant as an incentive for other countries to agree to come to a deal quickly,” said Mohit Kumar, chief economist for Europe at Jefferies. “We see more trade deals being signed in the coming weeks.”

Despite Monday’s dip, US equities remain near record territory. The S&P 500 has posted four record highs since June 27, driven by strong economic data, particularly a better-than-expected jobs report and cooling inflation.

“The renewed optimism appears to have been buoyed by a series of data points that have quelled some of the worst investor fears,” said Brian Belski, chief investment strategist at BMO Capital Markets.

Still, some strategists warn the market may be underestimating potential risks tied to trade tensions. Scott Wren of Wells Fargo Investment Institute said investor sentiment could prove overly optimistic.

“Our feeling is that stocks are ahead of themselves,” Wren wrote, noting concerns that higher tariffs could slow growth and weigh on consumer spending.

The Trump administration’s evolving trade policy also includes a newly announced 10% tariff on countries aligned with the BRICS bloc, which includes Brazil, Russia, India, China, and South Africa — all of which criticized US tariffs during a recent summit in Brazil.

Meanwhile, gold prices fell 0.8% on Monday, as demand for safe-haven assets declined. The US dollar index rose 0.2%, and bond yields edged higher. The 10-year Treasury yield rose to 4.38% from 4.34% late last week.

Some individual stocks also weighed on indexes. Tesla dropped 6.9%, the largest decline among S&P 500 companies, amid a renewed feud between CEO Elon Musk and President Trump over the recent passage of the Republican spending bill.

Tech and consumer discretionary sectors led the decline in the S&P 500. Oracle and Chipotle were down 1.9% and 2.9%, respectively.

In deal news, CoreWeave agreed to acquire Core Scientific, a cryptocurrency mining firm, in a $9 billion all-stock transaction. Shares in both companies fell on the announcement.

Oil markets were mixed after OPEC+ announced a production hike of 548,000 barrels per day beginning in August. US crude rose 1.2%, and Brent crude climbed 1.5%.

Globally, European markets were mostly higher, while Asian markets ended mostly lower.

Looking ahead, the Federal Reserve is expected to release minutes from its most recent meeting on Wednesday. Fed Chair Jerome Powell has indicated the central bank will monitor the inflationary impact of tariffs before adjusting interest rates.

With input from CNN and the Associated Press.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned