Markets Stabilize as Trump Delays Tariff Implementation, Signals Openness to Talks

Global stock markets showed resilience on Tuesday, bouncing back after President Donald Trump announced steep new tariffs on dozens of US trading partners—but extended their implementation deadline to August 1.

The move was widely interpreted as a signal that the administration remains open to continued negotiations, easing immediate fears of a full-scale trade conflict.

President Trump noted that the August 1 deadline is “firm, but not 100% firm,” suggesting that exemptions or reductions could still be negotiated. His administration has indicated it is willing to hear offers from affected countries in the weeks ahead.

The S&P 500 edged higher in early trading, while Asian markets—including Japan’s Nikkei and South Korea’s Kospi—also recorded modest gains. European indexes remained broadly stable, reflecting investor confidence that the latest round of trade threats may follow a familiar pattern: bold rhetoric followed by negotiated softening.

The relatively muted market reaction stood in contrast to the volatility seen earlier this year when Trump first floated reciprocal tariffs. Analysts suggested that investors have become more accustomed to the administration’s pattern of aggressive posturing followed by compromise.

“Either negotiations result, and a deal is announced, or another extension is granted,” wrote Chris Beauchamp, chief market analyst at IG Group. “Investors have come to expect this back-and-forth.”

This sentiment was echoed in trading activity. Gains in technology and healthcare sectors helped offset a dip in banking stocks. Shares of Intel rose more than 4%, while JPMorgan and Bank of America each slipped nearly 2%. Amazon shares dipped slightly as it launched a four-day Prime Day event.

Despite being directly affected by the new tariffs, markets in Japan and South Korea rose. South Korea’s Kospi index gained 1.8% even after Samsung Electronics reported a 56% drop in quarterly profits, highlighting how investor sentiment has been buoyed by hopes of a negotiated outcome.

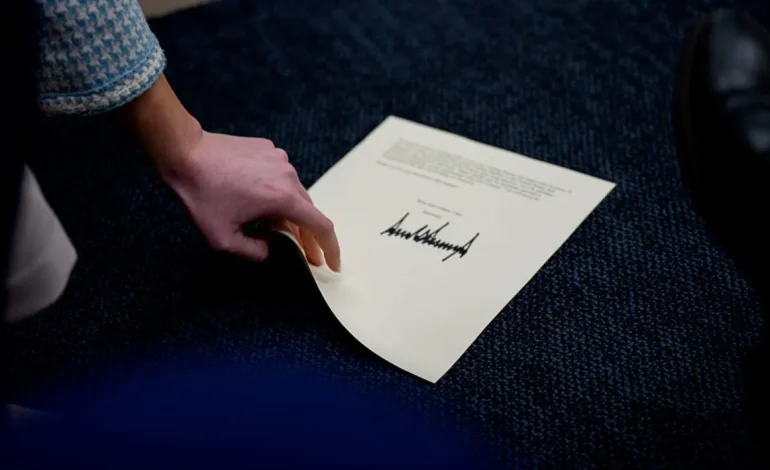

In Europe, the lack of immediate retaliation and speculation that a trade deal with the US may be close also helped steady nerves. An EU diplomat confirmed that a letter from the White House had not yet been sent to the bloc, giving more time for talks to progress. Reports indicated that EU Commission President Ursula von der Leyen had a “positive exchange” with Trump over the weekend.

Kiran Ganesh, strategist at UBS Global Wealth Management, said the absence of a letter to the EU “likely signals that a deal is within reach,” and that current tariff expectations are already reflected in the market.

Large US firms have also taken steps to cushion against the tariff impact. According to Goldman Sachs, many have the flexibility to adjust suppliers, manage costs, and tweak pricing strategies. Still, analysts at ING warned that “the ongoing uncertainty could do almost as much economic harm as the tariffs themselves.”

Dan Coatsworth of AJ Bell characterized investor optimism as the return of the “TACO” trade—short for “Trump Always Chickens Out”—pointing to past cases where the administration reversed course before deadlines.

That said, not all analysts are convinced the market is accurately pricing in long-term risks.

“One comprehensive trade deal could take months, even years,” said Toni Meadows of BRI Wealth Management. “At present, investors seem comfortable riding Trump’s seesaw path to policy setting, but tariffs are a tax on activity.”

With input from the New York Times, the Associated Press, and CNBC.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned