Trump Media & Technology Group, the Florida-based parent company of the Truth Social platform, has filed paperwork with the Securities and Exchange Commission (SEC) to launch a new exchange-traded fund (ETF) focused on cryptocurrencies, the Hill reports.

Named the “Crypto Blue Chip ETF,” the proposed fund would offer investors exposure to five widely traded digital assets.

According to the filing submitted Tuesday, the ETF’s portfolio would be composed primarily of bitcoin (70%) and ethereum (15%), the two largest cryptocurrencies by market capitalization. It would also include smaller allocations to solana (8%), ripple’s XRP (5%), and Cronos (2%), the latter of which is the native token of the exchange Crypto.com, which is expected to serve as the fund’s digital custodian.

Trump Media previously signaled plans for a crypto ETF limited to bitcoin and ethereum, though it remains unclear whether that earlier proposal will proceed alongside or be replaced by the new “blue chip” fund. The company did not immediately respond to a request for comment.

Cryptocurrency ETFs allow investors to participate in crypto markets without directly purchasing or storing digital coins, offering a more traditional route through regulated financial exchanges. These types of funds have grown in popularity since the first spot bitcoin ETFs began trading in the US in 2024.

The SEC’s updated guidelines for crypto ETFs, issued last week, are part of broader efforts under the Trump administration to create a more favorable regulatory environment for digital asset firms. Several pending enforcement actions against crypto companies have been paused or withdrawn, reflecting this shift in regulatory tone.

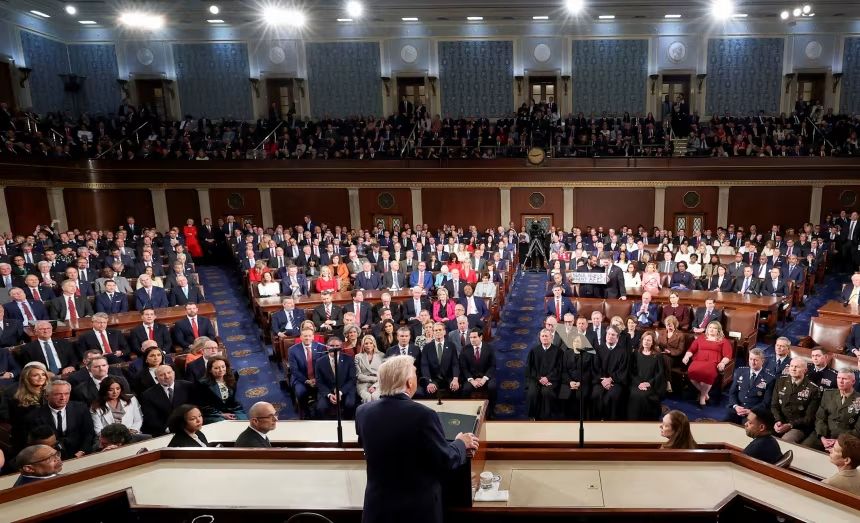

President Donald Trump, once publicly skeptical of cryptocurrencies, has become increasingly supportive of the sector, citing its growth potential and the importance of keeping the US competitive in global financial innovation. At a recent news conference, Trump emphasized his administration’s goals to establish the US as a leader in the digital asset space.

“If we didn’t have it, China would,” he said, defending his administration’s approach and dismissing concerns about potential conflicts of interest involving his family’s crypto business ventures.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned