China’s factory-gate prices continued their downward slide in June, falling at the fastest rate in nearly two years as deflationary pressures persist amid weak domestic demand and global trade tensions.

According to data released Wednesday by the National Bureau of Statistics (NBS), the Producer Price Index (PPI) dropped 3.6% year-over-year, marking the sharpest decline since July 2023 and exceeding economists’ expectations of a 3.2% fall.

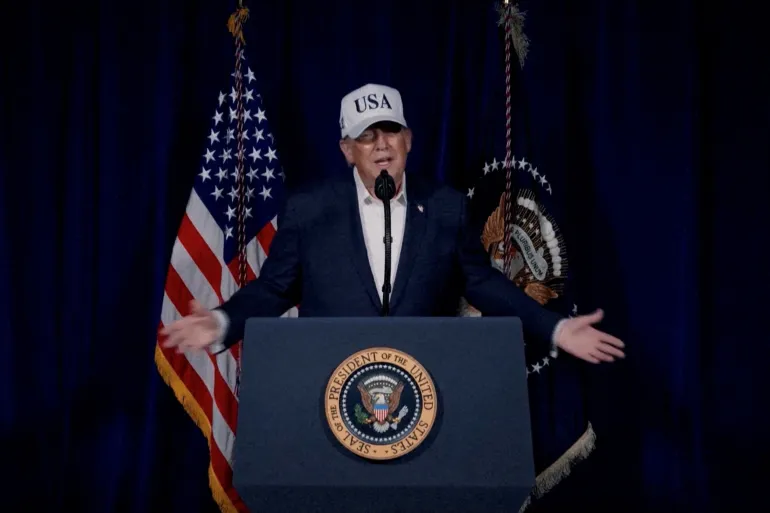

This deepening deflation highlights ongoing challenges for the world’s second-largest economy, including a sluggish property market, subdued consumer spending, and the impact of heightened trade frictions, particularly as US tariff policies under President Donald Trump continue to disrupt exports.

While consumer prices offered a glimmer of relief—rising 0.1% year-over-year in June after four months of decline—the uptick was modest. The increase, attributed largely to a government-backed consumer goods trade-in scheme, was slightly better than expected. Core inflation, which excludes food and energy, rose 0.7%, reaching its highest level in 14 months.

Despite the positive movement in consumer prices, analysts remain cautious.

“It’s too early to call an end to deflation,” said Zhiwei Zhang, chief economist at Pinpoint Asset Management, citing continued weakness in the property sector and intense price competition among manufacturers.

Export-oriented industries have been especially impacted, with many resorting to aggressive price cuts to clear inventory amid overcapacity. According to NBS statistician Dong Lijuan, “The uncertainty in the global trade environment has affected the export expectations of enterprises,” particularly as US-bound shipments remain volatile.

In response to mounting economic headwinds, Chinese policymakers have signaled a willingness to act. At a recent high-level meeting led by President Xi Jinping, officials criticized excessive price competition and pledged to phase out outdated production capacity. Industrial profits fell 9.1% in May, marking the steepest decline since October 2024.

While China’s exports posted year-over-year gains in recent months—thanks in part to increased trade with Southeast Asian nations—analysts warn that a slowdown in export demand could further strain growth.

“Without stronger policy stimulus, it’s hard to escape the ongoing deflationary spiral,” said Larry Hu, chief China economist at Macquarie.

Market reactions to the data were mixed. Mainland China’s CSI 300 index rose 0.19%, while Hong Kong’s Hang Seng index slipped 0.7%, reflecting investor caution amid uncertain economic signals.

Looking ahead, economists expect Chinese authorities to consider additional monetary easing, including potential interest rate cuts.

“Persistently soft inflation and the relative strength of the yuan give the People’s Bank of China room to act,” noted Lynn Song, chief economist for China at ING, adding that a rate cut could come in the fourth quarter if current trends persist.

With input from Reuters, CNBC, the Financial Times, and the Wall Street Journal.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned