US stocks climbed on Wednesday, buoyed by strong gains in the technology sector as Nvidia became the first company to surpass a $4 trillion market capitalization.

The rally comes after two consecutive losing sessions for the Dow Jones Industrial Average and amid investor focus on evolving trade and tariff policy under President Donald Trump.

The Dow rose 203 points, or 0.5%, while the S&P 500 gained 0.6%. The tech-heavy Nasdaq Composite outpaced both with a 0.9% increase, hitting another all-time high and continuing its remarkable upward trend since the debut of ChatGPT in late 2022.

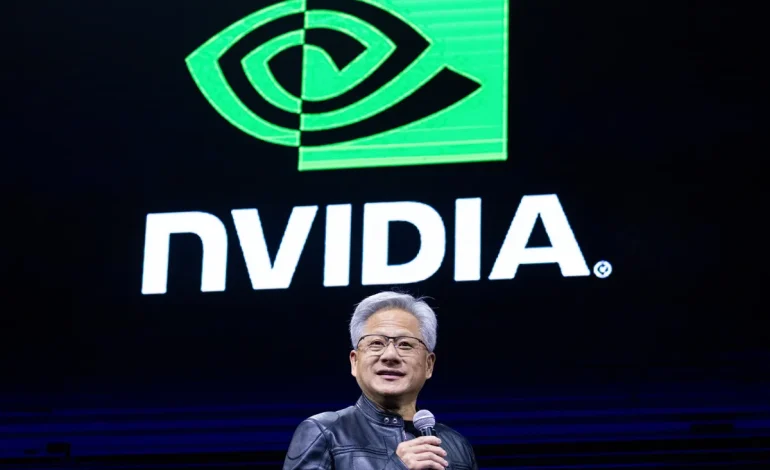

Leading the charge was Nvidia, whose shares rose more than 2% to push its market value beyond $4 trillion — the first company to do so. The chipmaker’s growth reflects surging demand for its AI-focused processors, which power data centers and infrastructure for companies like Microsoft, Amazon, and Google.

Nvidia’s ascent has been rapid: it crossed the $1 trillion mark in May 2023, and its stock has gained more than 1,000% since the beginning of that year. Analysts continue to express confidence in the company’s long-term potential, especially as AI investment remains a top priority for the tech industry.

Despite a new wave of tariff announcements from President Trump — including rates of up to 50% on copper and possible future levies of up to 200% on pharmaceutical imports — markets appeared unshaken. Trump’s tariffs, effective August 1, target countries including Japan, South Korea, the Philippines, and several others.

Investors are interpreting the delayed implementation and Trump’s tone as signs that there may still be room for negotiations.

“The market is just shrugging these tariff threats off,” said Ross Mayfield, investment strategist at Baird, suggesting traders are focused on deal-making potential rather than immediate disruption.

In addition to tariff developments, investors are awaiting the release of minutes from the Federal Reserve’s most recent policy meeting. While inflation concerns remain, some analysts argue that current conditions justify lower interest rates. Piper Sandler noted Wednesday that the inflation risks associated with tariffs are likely limited and called for modest rate cuts to support broader economic growth.

Beyond Nvidia, other major tech names also saw gains, including Meta, Microsoft, and Alphabet — all benefiting from renewed optimism around artificial intelligence.

Meanwhile, shares of UnitedHealth fell nearly 3% amid reports that the Department of Justice is questioning former employees about Medicare billing practices. On the merger front, Verona Pharma shares jumped 20% following news of a $10 billion acquisition by Merck, aimed at expanding its respiratory treatment portfolio.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned