US stock futures were steady early Thursday, following modest gains across major indexes the previous day, Investor’s Business Daily reports.

The Nasdaq Composite hit a new record high Wednesday as AI-driven momentum helped power tech stocks higher, with chipmaker Taiwan Semiconductor (TSMC) and Delta Air Lines delivering key earnings updates.

Dow Jones futures hovered just below fair value Thursday morning, with S&P 500 and Nasdaq futures showing minimal movement. Crude oil dipped nearly 1%, while the 10-year Treasury yield fell to 4.34%, snapping a five-day climb.

On Wednesday, the Dow rose 0.5%, the S&P 500 gained 0.6%, and the Nasdaq added 0.9%. The Russell 2000 index, representing small-cap stocks, climbed 1.1%, reaching its best level since February.

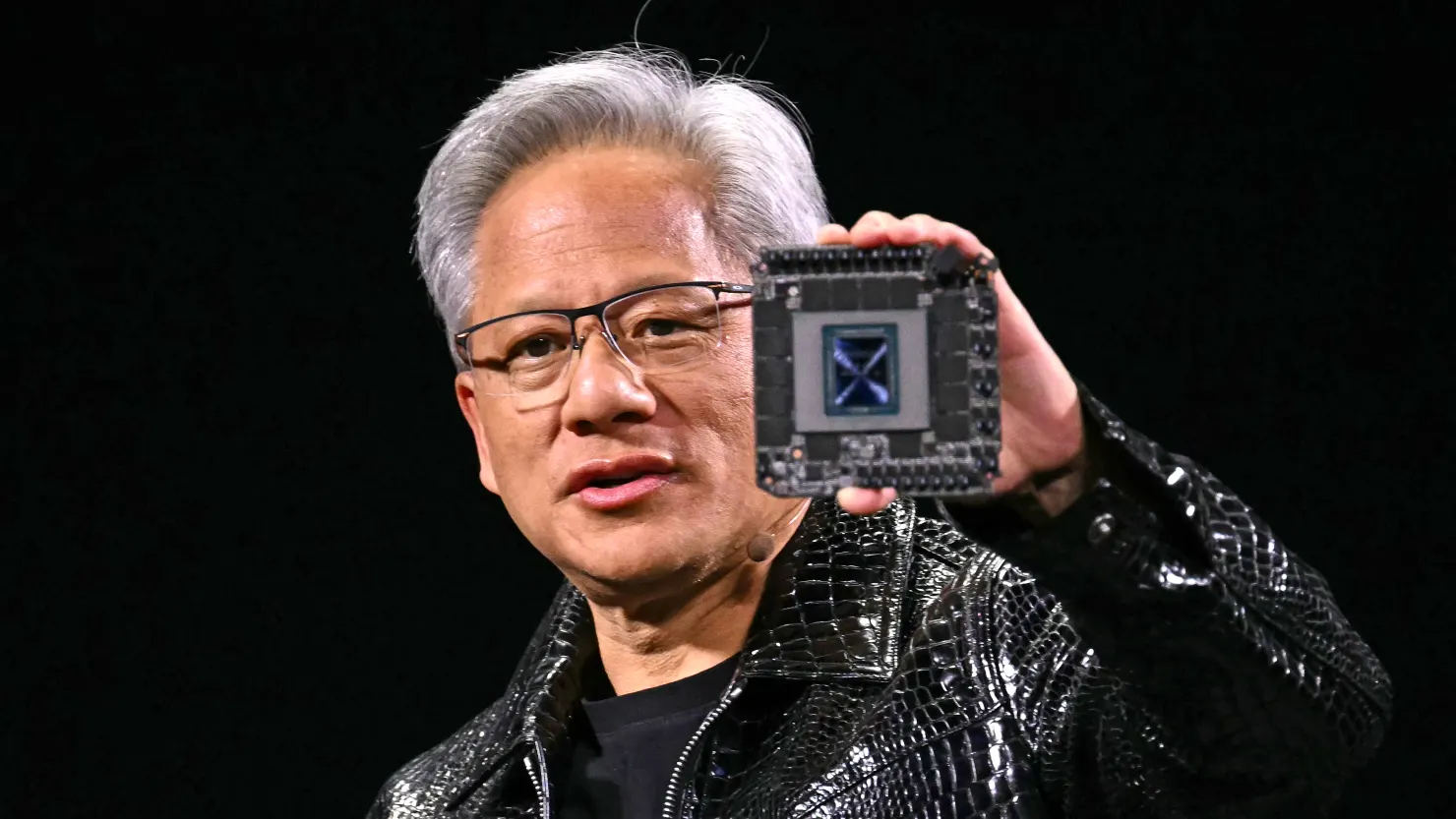

Taiwan Semiconductor (TSMC), a key supplier to Nvidia, Apple, and Broadcom, reported second-quarter sales that rose nearly 46% in US dollar terms — well ahead of expectations. The company’s performance is seen as a bellwether for the broader chip industry. TSMC stock edged higher in early trade.

Meanwhile, Delta Air Lines beat Wall Street’s earnings forecasts and raised its guidance for the summer quarter. Shares of Delta jumped more than 10% premarket, marking a potential breakout above its 200-day moving average. Other major airlines also gained in response to Delta’s strong results.

Artificial intelligence stocks continue to show leadership in the market. Astera Labs (ALAB), a 2024 IPO that supplies chips manufactured by TSMC, surged 8.2% on Wednesday and extended gains Thursday. The stock broke through key technical resistance levels, flashing a buy signal.

Cybersecurity firm Rubrik (RBRK) also posted a strong rebound, rising 5.4% and clearing recent resistance. The stock recovered after a modest drop earlier in the week, suggesting renewed investor confidence in its AI-focused offerings.

Nvidia (NVDA), which briefly topped a $4 trillion market cap Wednesday, continues to anchor the AI rally. The stock rose 1.8% during the regular session and edged higher premarket. Fellow chipmaker Broadcom (AVGO) and tech giants Meta (META), Alphabet (GOOGL), and Amazon (AMZN) also posted gains, reinforcing the sector’s strength.

Among ETFs, the semiconductor-focused VanEck Vectors Semiconductor ETF (SMH) climbed 0.7%, buoyed by Nvidia, Broadcom, and TSMC. The tech-heavy ARK Innovation ETF (ARKK) rose 2.1%, while the ARK Genomics ETF (ARKG) gained nearly 4%. The iShares Tech-Software Sector ETF (IGV) increased 0.4%, helped by Rubrik’s advance.

On the other hand, energy and mining sectors were mixed. The Energy Select SPDR ETF (XLE) declined 0.5%, while the SPDR S&P Metals & Mining ETF (XME) slipped 0.2%. US Global Jets ETF (JETS) eased 0.3%, despite Delta’s outperformance.

In international trade news, former President Donald Trump announced a 50% tariff on Brazilian imports, citing political tensions. The move affected shares of Brazilian jet maker Embraer (ERJ) and regional e-commerce leader MercadoLibre (MELI), both of which declined in extended trading.

Separately, US copper futures rose modestly following Trump’s confirmation that a 50% copper tariff would take effect August 1. The announcement comes amid broader efforts to reduce reliance on foreign critical minerals.

MP Materials (MP) soared in early trade after announcing a public-private partnership with the US Department of Defense to build a domestic rare earth magnet supply chain.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned