Asia-Pacific markets ended Monday with mixed results as investors assessed the implications of US President Donald Trump’s latest round of tariff announcements targeting the European Union and Mexico.

Meanwhile, interest in stocks associated with cryptocurrencies increased as Bitcoin surged to a new all-time high above $120,000.

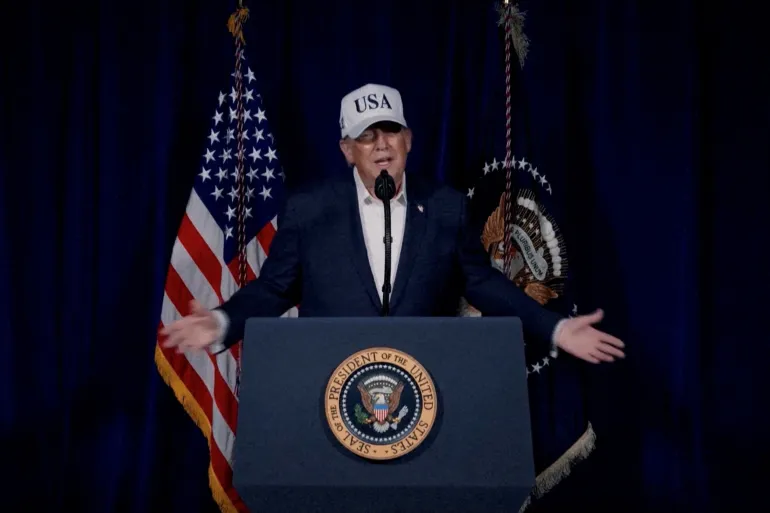

President Trump’s decision to impose 30% tariffs on most imports from the EU and Mexico, which takes effect on August 1, sparked new concerns about global trade and its potential effects on supply chains and corporate profits. Even though some analysts saw the announcement as part of ongoing negotiation strategies, market sentiment remained cautious.

Regional stock markets showed a split reaction:

Japan’s Nikkei 225 slipped 0.28% to close at 39,459.62, while the broader Topix index was nearly flat.

South Korea’s Kospi gained 0.83%, closing at 3,202.03.

Hong Kong’s Hang Seng Index rose 0.26% to 24,203.32, while China’s Shanghai Composite advanced 0.27%.

Australia’s S&P/ASX 200 edged lower by 0.11% to 8,570.40.

India’s Nifty 50 and Sensex both retreated in afternoon trade, down 0.27% and 0.46% respectively.

Amid trade tensions and mounting global inflationary pressures, Japanese 10-year government bond yields increased to a nearly two-month high of 1.554% in the bond market, indicating increased uncertainty and a reevaluation of risk.

Bitcoin kept up its upward trend, momentarily surpassing $121,000 and setting a new record high, further complicating the situation. Companies like Coinbase and Bitfarms reported gains as a result of the rally, which helped boost cryptocurrency-related stocks in pre-market US trading.

In June, imports increased 1.1% for the first time this year, while exports increased 5.8% year over year, surpassing analyst projections. According to the data, Chinese companies are reportedly increasing shipments in preparation for additional international tariff pressures.

Thanks to growth in manufacturing and construction, Singapore’s second-quarter GDP increased 1.4% on a quarterly basis and 4.3% on an annual basis, narrowly avoiding a technical recession. Officials cautioned about ongoing external uncertainties, though.

Japan, meanwhile, reported a marginally better-than-expected 0.6% monthly decline in core machinery orders for May. Despite the downturn, growth was 4.4% year over year, indicating cautious but robust business investment.

CNBC, The New Yorker, and US News & World Report contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned