China’s Export Growth Accelerates as Firms Rush to Ship Goods Ahead of Tariff Deadline

China’s export sector saw stronger-than-expected growth in June, as manufacturers increased shipments in advance of a significant US tariff deadline.

According to official customs data released Monday, the nation’s outbound trade increased 5.8% year-over-year in dollar terms, surpassing economists’ projections and signaling a recovery from May’s 4.8% increase.

Chinese exporters frontloaded shipments ahead of the August 12 expiration of a tariff truce agreed in May, as the temporary easing of trade tensions between Beijing and Washington coincided with the increase in exports. Analysts warn that without a more permanent trade agreement, the world’s two largest economies may soon reimpose duties exceeding 100%, potentially disrupting global supply chains.

In June, the first full month that Chinese goods benefited from lower tariffs under the truce, exports to the United States increased more than 32% month over month, although they decreased 16.1% from a year earlier. Exports to the European Union increased 7.6% year over year, while shipments to Southeast Asia, a vital transshipment route, increased 16.8%.

Additionally, China’s trade surplus increased from $103.2 billion in May to $114.7 billion in June. Imports increased 1.1% year over year, reversing a months-long decline ascribed to weak domestic demand and their first expansion of 2025.

Beijing’s trade performance in the first half of 2025 has provided a much-needed cushion for an economy grappling with a prolonged property market slump and deflationary pressure. The total trade surplus for the first six months hit $586 billion, nearly 35% higher than the same period last year.

Some of the strongest export growth was seen in rare earths, steel, and high-tech products. Rare earth shipments surged 60.3% in June from a year earlier, while steel exports topped 9.7 million tons. Integrated circuits, vehicles, and ships also posted notable gains. Crude oil and soybean products also increased in imports, especially from Saudi Arabia and Brazil.

Economists warn that the current momentum might not last, though. China economist Zichun Huang of Capital Economics cautioned that rising trade barriers and persistently high US tariffs may reduce the margins of Chinese manufacturers and impede future expansion.

“Tariffs are likely to remain high, and Chinese exporters face limits on how far they can compete by cutting prices,” she said.

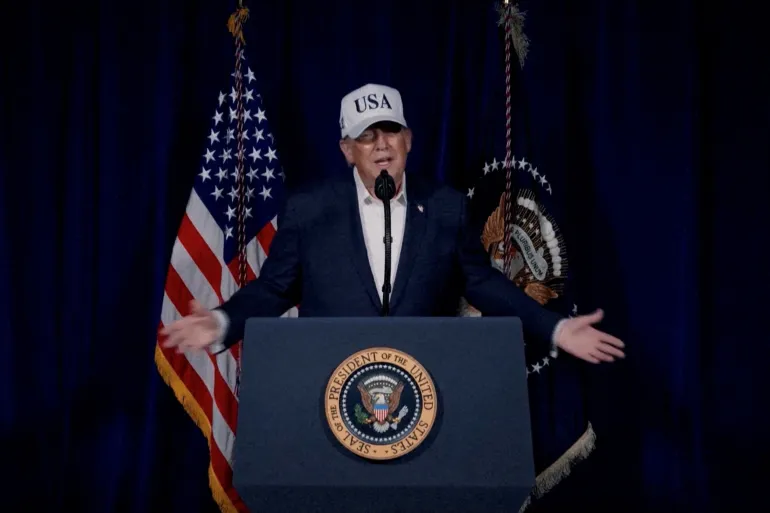

Adding to the uncertainty, US President Donald Trump has signaled the return of more aggressive trade measures. He recently introduced a 40% tariff on goods transshipped through Vietnam and threatened a 10% tariff on imports from BRICS nations, including China. These moves target widely used rerouting strategies and could impact China’s ability to avoid higher US duties.

Chinese officials maintain their optimism in spite of these obstacles. The recent trade truce was described as “hard-won” by Wang Lingjun, deputy head of China’s customs authority, who also urged both parties to expedite the implementation of agreements made during meetings in Switzerland and London.

The robust June trade numbers come before China releases its second-quarter GDP data, and analysts predict economic growth of roughly 5.1% annually, which is marginally higher than the government’s goal.

Economists emphasize, however, that trade might not be sufficient to maintain growth.

According to Zhiwei Zhang, chief economist at Pinpoint Asset Management, “the export frontloading has helped offset weak domestic consumption, but new fiscal stimulus may be needed to stabilize the broader economy if tariff tensions return.”

With input from the Financial Times, Reuters, Bloomberg, and CNBC.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned