Stock markets across Europe and Asia rallied after the European Union struck a last-minute trade deal with the Trump administration, easing fears of a tariff war and giving investors something to smile about—at least for now.

After weeks of brinkmanship, the US and EU finally landed an agreement that sets tariffs on most EU exports to the US at 15%. That’s way up from the pre-Trump 1%, but better than the feared all-out tariff slugfest that had been looming.

The announcement came after President Donald Trump met European Commission President Ursula von der Leyen at his Turnberry golf course in Scotland—a decidedly unconventional place to finalize a multibillion-dollar trade deal, but very on-brand for Trump.

European markets wasted no time reacting:

- Germany’s DAX rose 0.6%

- France’s CAC 40 climbed 0.8%

- Britain’s FTSE 100 nudged up 0.3%

US futures also moved higher, while oil prices ticked up ahead of another high-stakes round of trade talks—this time between US and Chinese officials in Stockholm.

In Asia, the picture was mostly upbeat:

- Hong Kong’s Hang Seng gained 0.7%

- Shanghai Composite edged up 0.1%

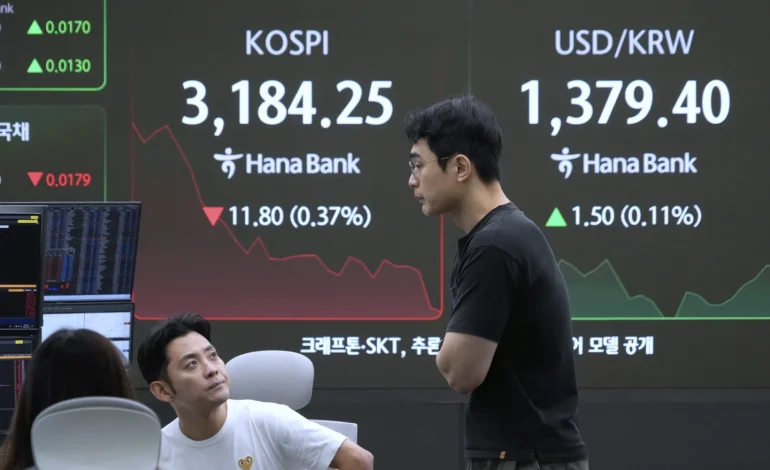

- South Korea’s Kospi rose 0.4%

- Australia’s ASX 200 added 0.4%

The exception? Tokyo’s Nikkei 225, which dropped 1.1% as doubts swirled around Japan’s recently announced (and still vague) $550 billion investment pledge tied to its own trade deal with Trump.

The EU deal is just the latest in Trump’s flurry of global trade moves. He’s already inked agreements with Japan and the Philippines, and now all eyes are on a key August 1 deadline, when another round of tariffs could be triggered if talks don’t continue to go smoothly.

Markets have surged in recent weeks on hopes that Trump’s hardball tactics are giving way to actual deals—and avoiding the worst-case economic fallout many had feared.

On Friday, US stocks closed out another record-breaking week:

- S&P 500 hit an all-time high, rising 0.4% to 6,388.64

- Dow Jones gained 0.5%, closing at 44,901.92

- Nasdaq added 0.2%, hitting a new peak at 21,108.32

Earnings reports helped too. Footwear giant Deckers (behind Ugg and Hoka) surged 11.3% after smashing expectations, thanks to booming sales abroad. Meanwhile, Intel tumbled 8.5% after posting a surprise loss and announcing sweeping job cuts as it struggles to keep pace with Nvidia and AMD in the AI chip race.

While the EU deal takes some immediate pressure off, the long-term picture is still murky. The deal hasn’t been fully inked, and there’s concern that 15% tariffs are still too steep to boost trade meaningfully. Plus, many in Europe are wary of future flip-flops from Washington.

And it’s not just trade. The Fed meets this week to talk interest rates. Trump’s been pressuring the central bank to cut rates again, saying it would save the US government money on debt. But Fed Chair Jerome Powell says he’s waiting for more economic data before making a move—likely holding off until September.

In Other Numbers:

- S. crude: +$0.40 to $65.56

- Brent crude: +$0.40 to $68.06

- Dollar: Up to 147.85 yen

- Euro: Down to $1.1719

With input from the Associated Press and the Hill.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned