Just a few years ago, UnitedHealth Group was seen as a poster child of American corporate success — a healthcare titan raking in billions, dominating both insurance and care delivery, and enjoying sky-high stock prices. Fast forward to today, and the mood has flipped hard.

Patients are furious. Investors are nervous. Regulators are circling. And UnitedHealth is scrambling to contain a full-blown identity crisis.

Over the past two years, the health care behemoth has been slammed with what can only be described as a corporate nightmare: a massive cyberattack, multiple federal investigations (including a criminal probe into its Medicare billing), the shocking murder of a top executive, and a wave of public backlash that’s rattled the entire US health care industry.

The company’s stock has nosedived, profits have fallen short, and in May, the pressure became too much for CEO Andrew Witty, who stepped down. In a move straight from a corporate drama, UnitedHealth brought back Stephen Hemsley, the 73-year-old former CEO, offering him a $60 million stock package to try to right the ship.

Hemsley’s plan? Same playbook he used before: leverage UnitedHealth’s sheer size — a $400 billion giant that insures 50 million people — to squeeze profits out of its massive, vertically integrated empire. On Tuesday, he’ll face the spotlight again as he reports quarterly earnings and outlines the company’s path forward.

But even if he calms Wall Street for now, UnitedHealth has a bigger problem: it’s rapidly becoming the villain in America’s broken health care story.

UnitedHealth doesn’t just insure Americans — it also runs the clinics, fills the prescriptions, and processes the payments. Through its subsidiaries, like UnitedHealthcare (insurance), Optum (care delivery), and Optum Rx (pharmacy benefits), the company is involved in nearly every aspect of a patient’s journey.

In fact, one of its units, Change Healthcare, handles about one-third of all medical transactions in the US That kind of reach would be impressive — if it weren’t scaring regulators and pissing off patients.

A ransomware attack on Change Healthcare last year locked up a huge chunk of the US payment system and exposed the data of 190 million people. It sent shockwaves through Washington and raised the question: is one company simply too powerful?

The Justice Department seems to think it’s worth looking into. UnitedHealth recently admitted it’s under both criminal and civil investigation over how it bills the government for its lucrative Medicare Advantage plans — a segment that’s become a major cash cow for insurers.

Insiders say UnitedHealth aggressively used diagnostic codes to make patients look sicker than they were, helping the company boost payments from the government. It’s a tactic others used too — but United was the most ambitious. That may now be backfiring.

What’s made matters worse is growing anger from the people UnitedHealth is supposed to serve.

Take Toby Turlay, a business owner from Washington, who says she battled the company for months to get mental health care for her child — only to end up paying tens of thousands out-of-pocket.

“It was a good six months of pure frustration,” she says.

Or cancer survivor Kate Weissman, whose life-saving proton therapy was denied by UnitedHealthcare. Her parents had to drain their retirement to pay the $95,000 bill. Weissman later sued — and won a settlement that forced the company to start covering the treatment in some cases.

Doctors, too, have criticized UnitedHealth for making it harder to get approvals, often citing the company’s use of AI algorithms in making decisions. While United insists the final say lies with physicians, critics say the process is opaque and exhausting by design.

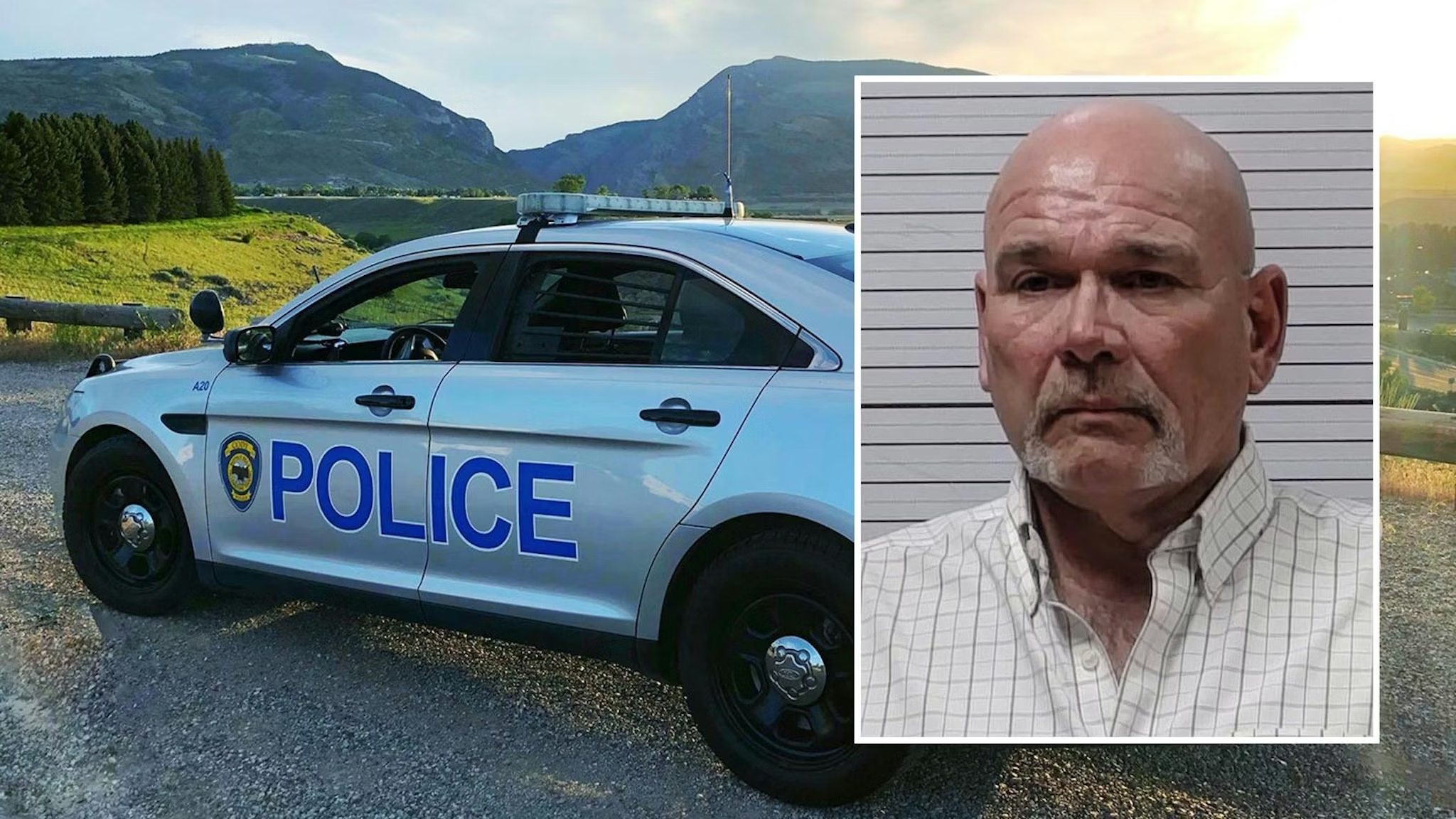

The public image hit was so severe, some even tied the killing of UnitedHealth executive Brian Thompson to rising frustration with the company, though the accused killer’s motive remains under investigation.

For years, Medicare Advantage was UnitedHealth’s golden goose. The company dominated the space, with millions of older Americans signing up for plans offering perks like dental, vision, and gym memberships. But regulators have started tightening the screws.

The Biden administration, in particular, has cracked down on coding practices and bonus payments, while pushing insurers to make approvals quicker and fairer. The financial hit has been real — especially at Optum Health, UnitedHealth’s physician services arm, which saw profits plummet earlier this year.

Analysts say the company should’ve been better prepared.

“It’s misexecution,” said one. “They knew the headwind and couldn’t find the offset.”

Tuesday’s earnings report will be Hemsley’s big moment to reassure investors. What they really want is clarity on 2025 earnings — guidance the company yanked earlier this year after Witty’s sudden exit.

So far, consensus estimates suggest adjusted earnings will be around $21.26 a share. But anything significantly below $18, and investors might bolt again. Analysts are also watching closely for updates on the troubled Medicare Advantage business and what the company is doing to steady Optum Health.

As for the government investigations, UnitedHealth is cooperating — but it’s also lawyered up. The company denies any wrongdoing and claims a court-appointed monitor already cleared it in one case.

UnitedHealth still argues that integrating insurance, doctors, and pharmacy services can lower costs and improve care.

“We think we’ve just scratched the surface,” says Dr. Wyatt Decker, a top executive.

But the numbers tell a different story: US health costs keep climbing. The average employer health plan now costs $25,000 a year per family, and America’s life expectancy lags behind other rich nations.

Former DOJ officials and economists warn that conglomerates like UnitedHealth may be making things worse by stifling competition and inflating costs. One even called it “Big Health 2.0” — where vertical integration doesn’t help patients but does help profits.

For now, UnitedHealth is in the eye of a storm — with patients, regulators, and shareholders all demanding answers. Whether Hemsley can deliver is anyone’s guess.

But one thing’s for sure: The days of coasting at the top are over.

The New York Times, CNBC, and Forbes contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned