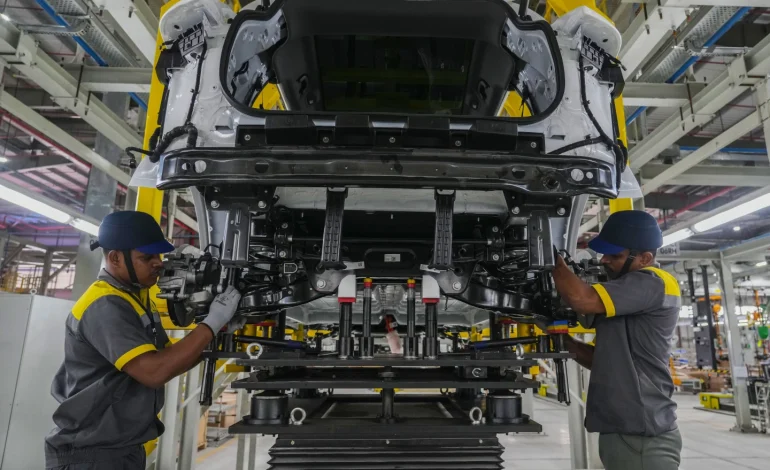

Vietnamese automaker VinFast just hit the accelerator in India, officially kicking off production at its brand-new electric vehicle (EV) plant in Thoothukudi, Tamil Nadu — a key move in the company’s $2 billion Asia expansion strategy.

Backed by a $500 million initial investment, the factory will churn out 50,000 EVs a year, with the ability to triple that output as demand grows. It’s strategically located near a major port, giving VinFast an edge in exporting to South Asia, the Middle East, and Africa.

“We picked Tamil Nadu after scouting 15 locations across six Indian states,” said VinFast Asia CEO Pham Sanh Chau, adding that the state’s strong auto ecosystem and infrastructure sealed the deal.

Tamil Nadu’s Industries Minister T.R.B. Raaja echoed the sentiment, saying this could jumpstart a whole new industrial cluster in South India.

“India needs more of these to become a global manufacturing powerhouse,” he said.

After hitting roadblocks in the US and Europe, VinFast is shifting focus to Asia’s fast-growing markets. It’s already building a $200 million plant in Indonesia and expanding in Thailand and the Philippines. But India — now the world’s third-largest car market — is the big prize.

In 2024, VinFast sold nearly 97,000 cars, triple its 2023 sales, though only about 10% were outside Vietnam. With its Indian factory now online, the company is eyeing not just local buyers but also export orders from countries like Sri Lanka, Nepal, and Mauritius, Chau confirmed to Reuters.

While two- and three-wheelers dominate India’s EV sales, passenger EVs are quickly catching up — sales jumped from under 2,000 in 2019 to over 110,000 in 2024. The Indian government wants EVs to make up a third of all car sales by 2030, and VinFast wants a piece of that pie.

So far, Tata Motors and Mahindra lead the domestic EV race, with international players like Hyundai and MG Motor battling it out in higher price brackets. Tesla recently launched its Model Y in India — at a jaw-dropping $80,000.

VinFast plans to enter later this year with its VF6 and VF7 SUVs, built for Indian roads and wallets.

“The market’s still wide open,” said autoX editor Ishan Raghav. “No automaker can afford to ignore it.”

VinFast also benefits from not being Chinese — a big advantage in post-2020 India, where border tensions led the government to block Chinese EV giants like BYD from setting up local plants. Some, like SAIC, had to partner with Indian firms just to stay in the game.

VinFast, meanwhile, scored incentives like lower land prices, tax breaks, and a welcome mat from Indian officials, all thanks to New Delhi’s push for local manufacturing over imports.

That said, India’s car buyers are picky, price-conscious, and cautious, especially when it comes to EVs. VinFast will need more than shiny vehicles — it’ll need to prove reliability, offer after-sales support, and build serious scale.

To do that, it’s launching 32 dealerships in 27 cities, building out service centers, and partnering with local companies on charging and repairs. It’s even working on recycling batteries and making powertrains in India to keep costs down.

“If they get pricing and quality right, they could actually go far,” said Vivek Gulia of JMK Research.

VinFast aims to deliver 200,000 vehicles globally in 2025, and the India plant is central to that goal. It’s already drawing supplier interest — even from Vietnamese firms — to shift operations to India’s more stable and cost-effective manufacturing base.

Chau confirmed the plant already has orders from several countries and could quickly evolve into an export hub, but for now, the main focus is on winning India.

VinFast is going all-in on Asia. And if it plays its cards right, the Vietnamese upstart could become a serious contender in one of the world’s most exciting — and competitive — EV markets.

With input from the Associated Press and Reuters.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned