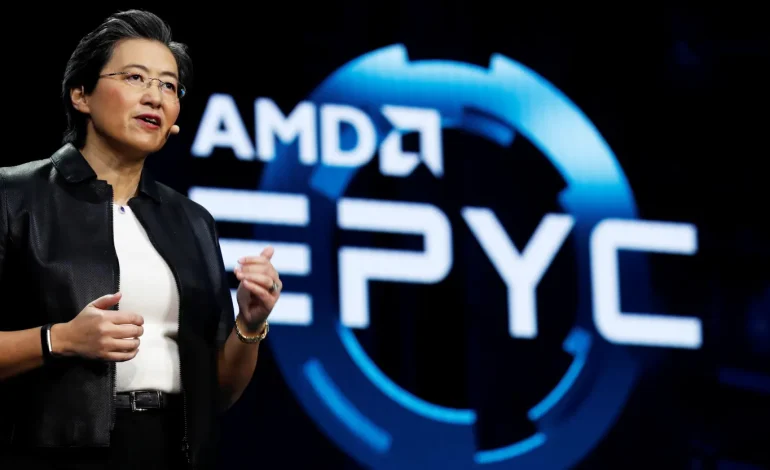

Shares of AMD took a hit Wednesday, sliding over 7%, after the chipmaker beat revenue expectations but came up short on earnings — and raised fresh doubts about its China AI chip business.

While AMD raked in $7.69 billion in revenue last quarter (up 32% from last year and better than analysts expected), its adjusted earnings came in at 48 cents a share, missing Wall Street’s target by a penny. That minor miss, combined with growing anxiety about China sales, was enough to send investors heading for the exits.

CEO Lisa Su didn’t sugarcoat it on the company’s earnings call:

“AI business revenue declined year over year as US export restrictions effectively eliminated MI308 sales to China.”

She added that AMD is now in the middle of transitioning to its next-gen chips.

Translation: they’re stuck in a holding pattern while navigating US licensing rules — and that’s got Wall Street nervous.

AMD had previously warned it would take an $800 million hit in Q2 due to those chip restrictions. While the company hopes to resume China shipments soon, there’s no clear timeline.

“We’re working closely with the Trump administration,” Su told CNBC, “but we took a prudent approach with our guidance.”

Investors were hoping for more clarity. Instead, they got vague promises and no updates on when those crucial MI308 shipments might actually resume.

Morgan Stanley called the outlook on China “uncertain,” and Bernstein wasn’t thrilled either, warning that “inventory risks remain” and AMD’s rising expenses are eating into its profits. Goldman Sachs chimed in with concerns about whether AMD can really scale its data center GPU business, even though it’s showing growth.

That datacenter division, which includes CPUs and GPUs, grew 14% year-over-year to $3.2 billion — solid, but not enough to offset fears. Some analysts say the heavy investment in software and infrastructure needed to compete in the AI space could weigh on profits for a while.

Su remains optimistic.

“We see strong forecasts for compute demand from our largest customers,” she said, predicting a turning point in the third quarter. “The data center business is really our main growth engine.”

For now, though, investors seem spooked. Despite the revenue beat and a big jump in net income — $872 million this quarter compared to $265 million a year ago — the market clearly wanted more reassurance.

And with Nvidia and other rivals charging full speed ahead in the AI race, AMD’s murky China strategy and slim earnings miss couldn’t have come at a worse time.

The original story by Samantha Subin for CNBC.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned