Wyoming lawmakers are revving up plans to give the state’s oil industry a serious shot in the arm — and they’re willing to spend money and slash taxes to make it happen, Casper Star-Tribune reports.

At a legislative meeting in Casper this week, members of the Minerals, Business & Economic Development Committee agreed to draft two bills designed to supercharge Enhanced Oil Recovery (EOR) — a technique that pulls extra oil out of wells that would otherwise be tapped out.

The idea? Make Wyoming one of the most EOR-friendly states in the country by offering more cash per ton of CO₂ used and giving oil companies a tax break to set up shop here.

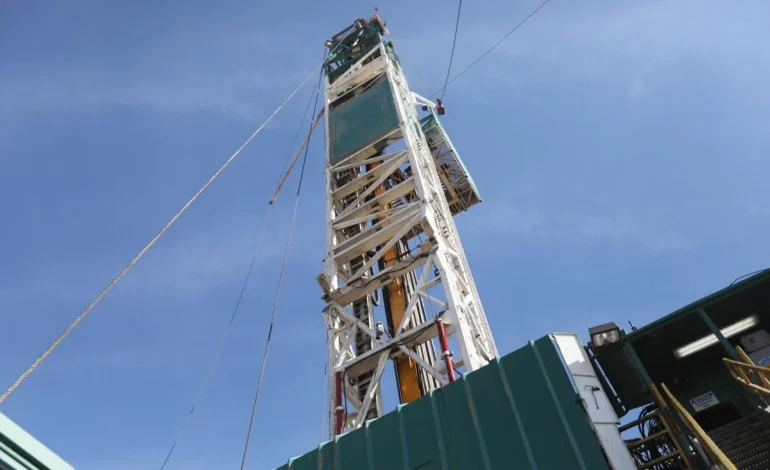

Enhanced Oil Recovery is like squeezing the last bit of toothpaste out of the tube. Companies inject pressurized CO₂ underground to extract oil that’s left behind after traditional methods stop working.

It’s already happening in nine oil fields across Wyoming, and it made up about 10% of the state’s oil output from 2010 to 2020, according to the Enhanced Oil Recovery Institute.

But lawmakers want more — and they think Wyoming can become a top destination for EOR projects, especially with access to massive amounts of captured CO₂ from places like Shute Creek in Sweetwater County.

“We have abundant CO₂ being captured right now,” said Lon Whitman, director of the EORI. “But new capture projects are expensive — they need that $85-a-ton federal credit just to make sense financially.”

Earlier this year, lawmakers passed Senate File 17, offering companies an extra $10 per ton of CO₂ used in EOR — on top of federal incentives.

But then Congress passed the One Big Beautiful Bill Act, which bumped the federal tax credit for EOR from $60 to $85 per ton, making SF17 outdated before it even got off the ground.

So, lawmakers want to revive the concept — but with a smaller state bonus of $5 per ton, giving Wyoming a slight edge over other states that haven’t added their own incentives.

“It’s the same idea as SF17, costs half as much, and keeps Wyoming competitive,” said Sen. Chris Rothfuss (D–Laramie), who led the charge.

“It’s a win-win,” added Sen. Tara Nethercott (R–Cheyenne). “This gives our oil and gas industry a serious edge.”

The committee unanimously voted to draft a new version of the bill with the updated bonus.

The second proposal looks back to House Bill 54, passed way back in 2003. That law exempted EOR developers from Wyoming’s 6% severance tax for five years.

And while the state temporarily gave up $29.4 million in tax revenue, the long-term return was massive: $236 million in taxes from those projects between 2009 and 2024 — a net gain of over $200 million.

“That’s called good policymaking,” Nethercott said. “This deal helped build lasting economic growth.”

Lawmakers voted again — unanimously — to draft a reboot of HB54, aiming to attract new EOR developers to Wyoming.

Interestingly, the main reason for the Casper meeting — forming a regional agreement with Montana, North Dakota, Saskatchewan, and Alberta to expand CO₂ pipeline infrastructure — got pushed to the back burner.

Instead of signing a formal compact, lawmakers agreed to keep the lines of communication open but stopped short of passing a joint resolution.

“We can already start talks without this,” said Rep. Christopher Knapp (R–Gillette). “The resolution just doesn’t feel necessary.”

Because of time constraints, lawmakers didn’t get a chance to fully vote on the proposed bills — but there’s strong interest in adding a third day to the interim session so the committee can finalize both measures and recommend them for consideration in the next legislative session.

If they move forward, Wyoming could soon be offering oil companies more money per ton of CO₂ and five years of tax breaks — all in a bid to keep the state’s oil fields humming and its economy growing.

“It’s about staying competitive,” Rothfuss said. “And making sure Wyoming doesn’t get left behind.”

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned