The US government isn’t stopping at Intel — at least if one of Donald Trump’s top economic advisers is to be believed.

Kevin Hassett, director of the National Economic Council, said Monday that Washington could scoop up more slices of private companies, hinting the Intel deal might be just the opening act of something bigger: a US sovereign wealth fund.

The government last week quietly became Intel’s biggest shareholder, grabbing nearly 10% of the chipmaker using money originally meant as grants under Biden’s CHIPS Act. Hassett framed the move as “like a down payment on a sovereign wealth fund,” pointing out that plenty of countries in Europe, Asia, and the Middle East already use such vehicles to invest in companies and assets.

It’s not unheard of for Uncle Sam to take equity stakes — the 2008 financial crisis was a prime example — but this time it’s not about bailing out a sinking bank. Hassett called the Intel deal a “very, very special circumstance” tied to the billions Intel was already getting from the CHIPS Act. Still, he made clear more deals are likely:

“If not in this industry, in other industries.”

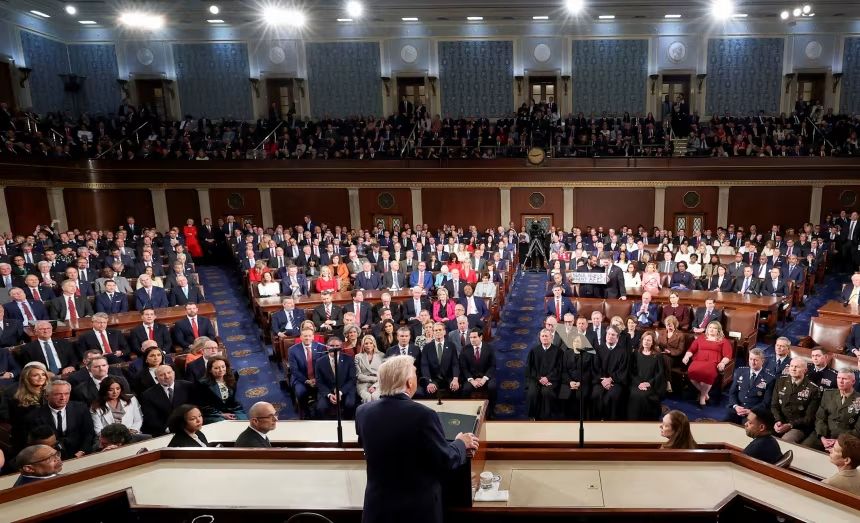

Trump himself quickly jumped into the fray, taking to Truth Social with his own spin:

“I PAID ZERO FOR INTEL, IT IS WORTH APPROXIMATELY 11 BILLION DOLLARS. All goes to the USA.”

That’s not exactly true. The feds shelled out $8.9 billion for more than 433 million shares at $20.47 apiece. But Trump is leaning hard on the message that America got a bargain and that he’s willing to cut more deals like it.

Not everyone’s cheering. Intel, in an SEC filing Monday, bluntly warned the government stake could backfire. With 76% of its sales coming from overseas, the chip giant fears foreign governments, business partners, employees, and even investors could revolt at being tied to Trump’s volatile trade and tariff policies. Intel also flagged the risk of lawsuits, political backlash, and a flat-out challenge to the deal if Washington shifts course.

Markets, though, have so far played along — Intel’s stock has rallied on the expectation of government backing. But the filing also revealed that Commerce gets voting rights alongside Intel’s board, limiting what other shareholders can push through.

Critics across the spectrum are blasting the move as heavy-handed government meddling. Sen. Rand Paul called it a “terrible idea.” California Gov. Gavin Newsom went further, labeling the US under Trump the “socialist republic of America.” Even Trump’s former UN ambassador Nikki Haley warned Intel could become “a test case of what not to do.”

Hassett brushed aside the backlash, suggesting the US Treasury holding company shares isn’t all that different from what other countries do.

“If the US Treasury has more of that stuff, that is starting to look like a sovereign wealth fund,” he said.

For now, Intel is the test balloon. But if Hassett is right, Americans may be watching the early stages of a historic shift — from Washington writing checks to Washington owning big pieces of corporate America.

With input from NBC News, CNBC, Axios, and the Washington Post.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned