South Korea’s two biggest chipmakers took a hit Monday after Washington shut down a loophole that had let them quietly ship US chipmaking gear into China without the usual red tape.

SK Hynix shares tumbled nearly 5%, while Samsung Electronics slipped more than 2%, after the US Commerce Department said it was revoking their “validated end user” status. That special waiver, introduced under President Biden, allowed the companies to keep their giant Chinese plants humming without applying for export licenses each time they needed US machinery.

Now that waiver’s gone. Going forward, Samsung and Hynix will need approval for each shipment of US-made tools—licenses that officials say will be granted for maintenance but not for upgrades or capacity expansion.

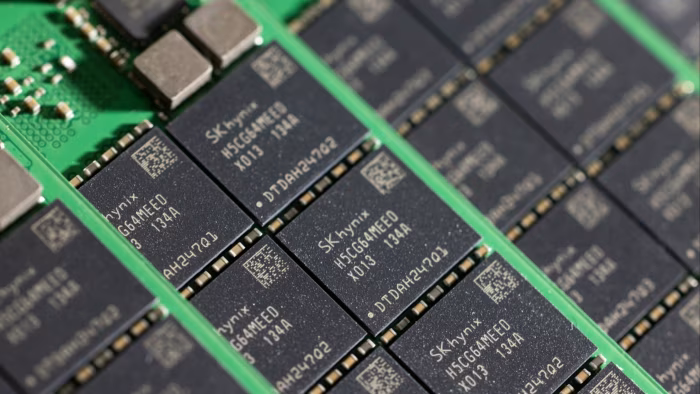

The move hits right at the heart of their Chinese operations. Samsung’s Xi’an plant produces about a third of its NAND flash memory, the chips that store data in your phone and laptop. Hynix is even more exposed: its Wuxi fab cranks out 35% of its DRAM chips, and its newer Dalian site—bought from Intel—handles more than a third of its NAND.

Analysts say the immediate impact is limited, but the long-term story is tougher. Without the ability to upgrade their Chinese fabs, Samsung and Hynix risk falling behind on the latest chip tech while still pumping out so-called “legacy” memory.

The decision comes as the US ramps up its semiconductor fight with China. Officials say closing the waiver prevents American technology from fueling China’s chip industry. But it also puts Korean companies in a bind, since they rely heavily on their Chinese fabs for global supply.

“Samsung and SK Hynix had been betting those waivers would last,” said CW Chung, an analyst at Nomura. “Now they’ll have to rethink their entire China strategy.”

Meanwhile, rivals like Micron in the US could benefit, since they’re less exposed to China.

For now, both companies say they’ll work closely with Seoul and Washington to “minimize the impact.” But with 120 days until the waivers officially expire, the clock is ticking on how South Korea’s chip champions navigate the US-China tech crossfire.

The Financial Times, Reuters, and Bloomberg contributed to this report.

The latest news in your social feeds

Subscribe to our social media platforms to stay tuned